Climate Risk Assessment and Management for Business Leaders - Last Updated: March 30, 2022

What is Climate Risk Management?

For companies, climate risk management is the formal process of assessing, understanding, and protecting a business against the consequences and impacts of climate change. For example, an insurance company might insure property near the ocean in a region where climate change is scientifically proven to increase storms and raise sea levels. Since climate change increases the risk those homes or buildings suffer weather damage, climate change creates material financial risk for that business which needs to be managed.

As executive leaders and climate risk managers, our goal is to assess and manage the chance (probability) of harmful outcomes or expected losses to our business and brand caused by climate change, as well as navigate those conditions and adverse events when they occur.

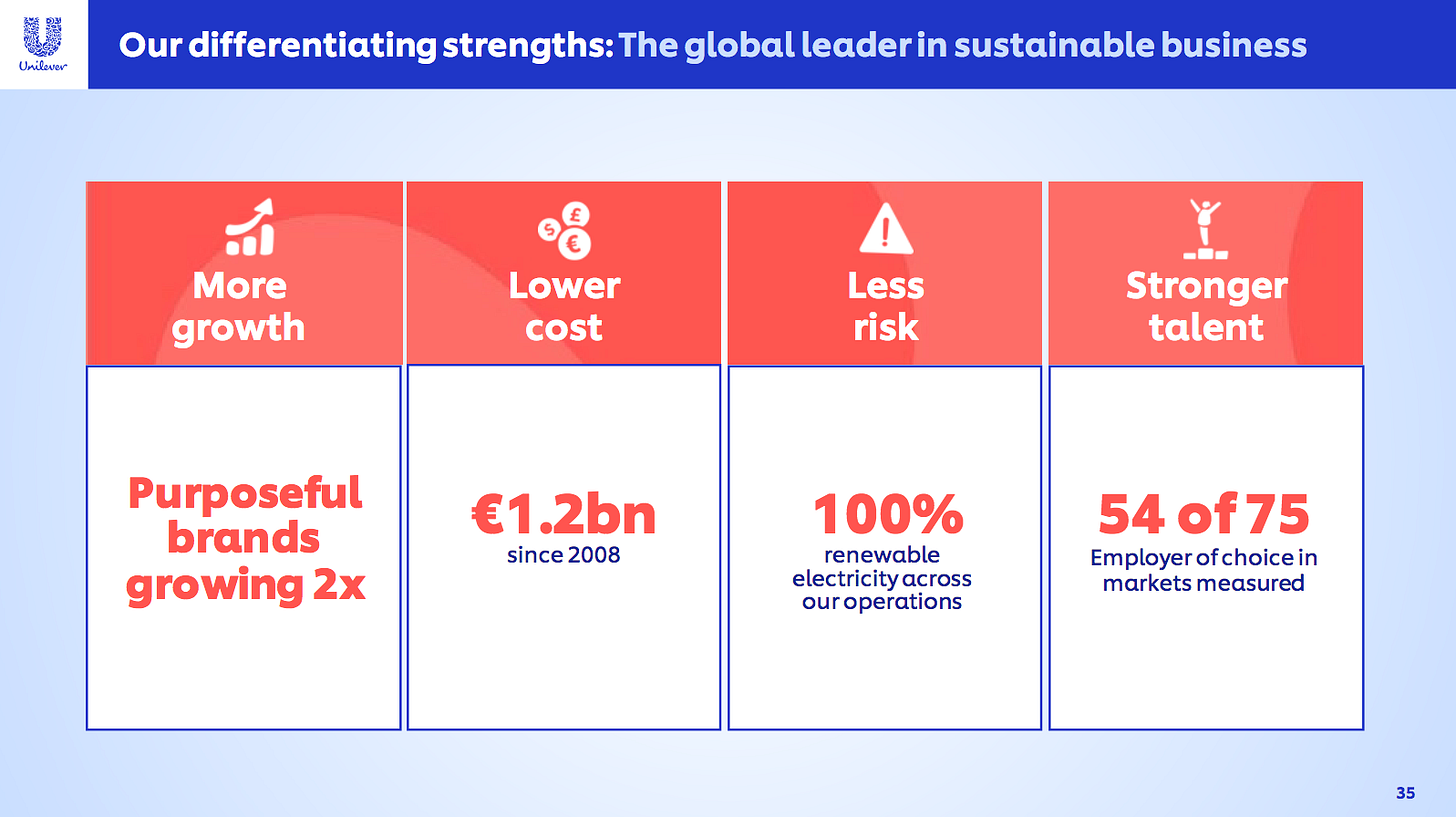

Given climate change's far-reaching impacts on the Earth, natural systems, and the economy, almost every company and industry is impacted by climate change in some way, from corporations like Apple, Nike, and Walmart down to small businesses. Global food company Unilever estimates it loses over €300 million a year due to worsening water scarcity and declining agricultural productivity caused by climate change. But on the flip side, adopting more sustainable sourcing practices has helped Unilever realize over €1.2 billion in cost savings since 2008.

Source: Unilever

Strategies and Approaches to Climate Risk Management

Climate change risk management approaches generally fall into five categories:

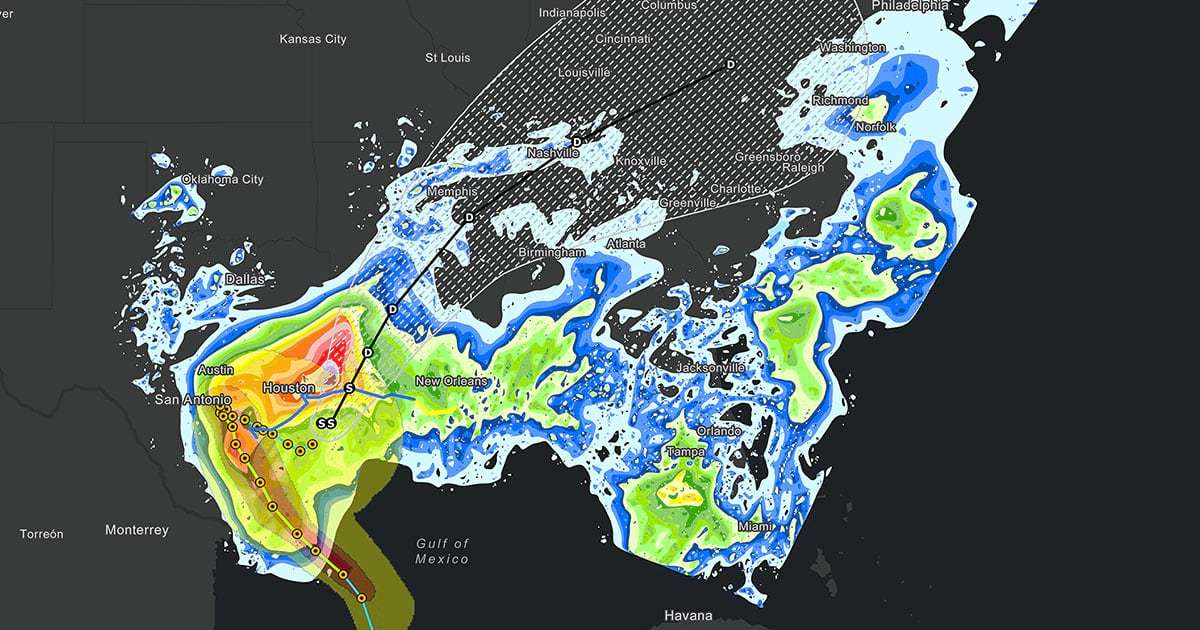

- Prediction, Forecasting, and Modeling - Efforts to anticipate or predict risks from climate change, including wildfire monitoring, extreme weather forecasting, or dynamic scenario planning

- Mitigation - Efforts to reduce greenhouse gas emissions, other environmental impacts, or their impacts and consequences

- Adaptation - Strategies and tactics that improve an organization or value chain's capacity to cope with changes in climate

- Engineering - Climate, bio, or geo-engineering approaches to manipulate Earth's resources to counteract climate deterioration of natural systems, like, for example, cloud seeding to produce rainfall or breeding more drought-resilient crop species

- Understanding - Science, technology, knowledge, and education efforts to better understand and communicate the mechanisms of climate change and natural systems to support proactive climate risk management and innovation

Effective climate risk management should assess the most severe risks from climate change to your business model, identify which risk management approaches make sense for your organization, then institute the operational and governance steps to keep pace or ideally get ahead of your company's ongoing climate risks.

Severe Weather Tracking and Climate Risk Forecasting. Source: ESRI

Regulatory Climate Risk

In addition to acute physical risks from climate change, many companies - particularly publicly-listed firms - will also need to account for regulatory climate risk. In the United States, the SEC (Securities and Exchange Commission) announced a plan in March 2022 called "The Enhancement and Standardization of Climate-Related Disclosures for Investors." The SEC's new climate disclosure framework will introduce mandatory climate risk reporting requirements for registered companies. In Europe, the Corporate Sustainability Reporting Directive (CSRD) is an upcoming set of EU rules designed to make corporate sustainability reporting more standardized like financial accounting and reporting. Other countries and stock exchange operators, including Australia, Canada, Singapore, and the United Kingdom are also broadening climate risk rules for large companies and financial institutions.

In our view, planning for both physical and regulatory climate risk management is increasingly important for modern CFOs, risk officers, and ESG leaders need to be proactive around.

Finally, it's also worth recognizing regulatory climate risk has downstream and value chain implications for smaller businesses. Walmart has over 3,000 suppliers. In the UK, grocery chain Tesco works with over 2,500. While many of these suppliers may not be legally obligated to report on their climate risks and greenhouse gas (GHG) emissions, they will increasingly be engaged by their largest customers who do need to collect and disclose this data to regulators. Your small business may receive a climate risk rating from your top vendor relationships.

Materiality Assessment for Climate Risk

To assess, map, and rank your company's climate risks, we recommend completing a materiality assessment. Materiality is a powerful tool in climate risk strategy, and a valuable exercise for identifying the full extent of your firm's climate risk profile.

Materiality comes from 'material'. Not material like a physical ingredient, but material meaning important to an organization. A material climate change opportunity is something that can positively impact your company's business model, revenue, or profits - like reducing energy purchase costs by switching to renewable energy. A material ESG (environmental social governance) or climate risk is a headwind that negatively impacts your operating or financial performance. Materiality is the principle of defining the social and environmental topics that matter most for your business, customers, investors, and other stakeholders.

At Brightest, when we work with a company or partner on materiality, we typically start with an industry and competitive landscape evaluation to understand what your peers are focusing on across ESG, sustainability, and climate risk. Next, we gather internal and external data and feedback to create a structured map of what ESG and climate risk topics matter most for your organization. Finally, we synthesize, organize, and quantify those topics into a materiality matrix, strategic plan, and set of recommendations that can be owned, adopted, and cultivated by your brand, executive leadership, and employees.

For clients using our sustainability and ESG software, our system can efficiently survey stakeholders, collect data, and auto-generate a materiality matrix, which ranks and organizes your priority materiality topics. A materiality matrix typically measures three topic attributes:

- X-Axis - Importance (materiality) to your company

- Y-Axis - Importance (materiality) to your stakeholders (investors, partners, community, etc.)

- Bubble Size - Your company's capacity or ability to positively influence or work on the topic

You can also think of "importance" as a relative risk rating, which is why materiality can be especially useful for structuring and quantifying climate risk.

Conducted thoughtfully, we believe companies who fully consider materiality create stronger, more resilient, and thoughtful climate risk plans. Materiality assessments also strengthen your organization's ability to inform investors, regulators, and other stakeholders about your climate risks, opportunities, and impacts.

Climate Risk Categories

A second helpful climate risk framework is the Task-Force for Climate-Related Financial Disclosures (TCFD). TCFD can be helpful for categorizing your company's climate risks, as well as offering guidance on how to communicate and disclose them.

TCFD's climate risk categories - which we consider broadly representative - are:

- Economic Transition Risk - Transitioning to a lower-carbon economy will entail extensive policy, legal, technology, and market changes related to climate change. Depending on your industry and the nature, speed, and focus of that transition, different organizations and economic sectors will be exposed to varying levels of financial and reputational risk

- Policy Risk - Policy actions around climate change continue to evolve, and differ around the world. Climate policy itself may be a source of business risk (and opportunity) for companies

- Legal Risk - This includes legal exposure to climate-related litigation being from property owners, governments, insurers, shareholders, and public interest organizations

- Technology Risk - Technology changes that support the transition to a lower-carbon, energy-efficient economy can have a significant impact on organizations. Renewable energy, energy efficiency, carbon capture, and sustainable supply chain shifts may have impact a company or industry's costs, financial risks, and products and services, with broad potential value chain implications

- Market Risk - Adressing climate change requires sweeping, multi-sector economic changes. In the course of this transition new markets will be created, existing markets will adapt, and some markets (like coal power) may become obselete or unbankable in many parts of the world

- Reputation Risk - As investor, regulatory, customer, supplier, and community perceptions about the risks of climate change and the importance of climate action develop, companies that don't align their brand, operations, and investments with a lower-carbon economy will face greater reputation risk

- Acute Physical Risk - Climate risks that are immediate, physical, and event-driven, including severe storms, wildfires, hurricanes, floods, and droughts

- Chronic Physical Risk - Risks from longer-term environmental and weather shifts, such as sustained higher temperates, water scarcity, or chronic heat waves

A comprehensive climate risk plan should assess and understand how each of these climate risk categories impact your company.

Ongoing Climate Risk Management and Other Frameworks

Whether you use a formal materiality process to assess your organization's climate risks or not, once you've identified your climate risk exposure it's important to put teams, tools, and processes in place to manage it. For operationalizing climate risk management as a business leader, we recommend considering the following principles and steps:

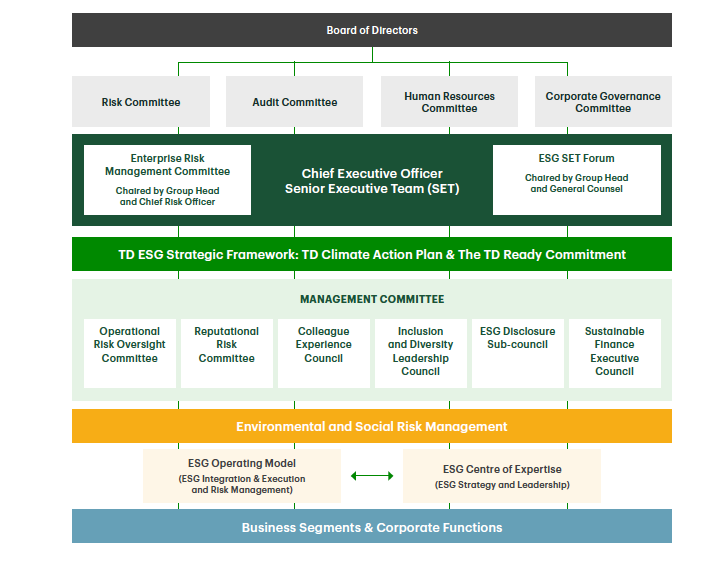

- Climate risk needs leadership, governance, and accountability - Senior management should set the tone inside the company on climate risk and ESG governance. Appoint a designated leader like the CFO, Chief Risk Officer, or Director of Sustainability to be responsible for climate risk. Set up internal ESG reporting workflows and structures to ensure your board, senior leadership, and investors are aware of your company's material climate exposure areas and can respond accordingly. Work to identify potential climate-related threats and scenarios around your long-term strategic plan, business model, and investments.

- Hire knowledgeable climate talent and educate existing teams - Strong climate risk management and ESG performance starts with capable, experienced sustainability leadership, but also extends to educating employees about climate risks and opportunities and why they matter. Make sure you have the right talent, education programs, and internal communications strategy in place to assess and manage climate risk.

- Climate risk needs to be part of investment and procurement decisions - Climate considerations should be integrated throughout your company's risk frameworks, procurement policies, and investment allocation processes. Draft formal policies, approval criteria, and decision-making thresholds.

- Use methods like materiality and scenario analysis - The more comprehensive your climate risk assessment lens, the better positioned you'll be to identify material risks to your business. Thoughtful scenario, strategic, and operational contingency planning is also immensely valuable for managing and responding to climate risk.

- Build data science and systems capacity - Many companies lack the technical skills needed to fully assess and manage their climate risk. Focus on learning and building climate risk agility, resilience, and understanding. Budget for increased investment in ESG technology, data science, and talent.

- Create and communicate clear, actionable policies - Does your organization have a supplier code of conduct that embeds climate and sustainability principles? Do you have disaster recovery plans and policies in place? Does your employee travel policy consider climate impacts? Make sure to embed and integrate climate risk management actions and thinkings across your company policies.

Ultimately, climate risk starts with executive leadership but extends across your entire company structure and culture. Whether you're a global brand or a growing startup, climate should be a consideration throughout your business model and decion-making.

ESG and climate risk governance structure example. Source: TD Bank

Your Next Steps With Climate Risk Management

Your company's climate risk profile and management approach should depend on who are as an organization, including:

Your industry and business model

Your organization's size

Where you do business and have physical operations

Your supply chain

Your internal ESG, sustainability, and risk management maturity and capacity

Your other operational controls and policies

For organizations in the early stages of their sustainability journey, some of the best places to start with climate risk are (a) appointing a designated internal lead, (b) performing a materiality assessment, and (c) deciding on an operation plan that takes climate risks and opportunities into account. By comparison, more mature organizations should look to scale and share internal best practices, make their climate risk management process more proactive and scenario/data/forecast-driven, and identify the best actions and opportunities to foster sustainable innovation, operational efficiency, and reduce climate risk.

Wherever you're staring from, managing climate risk and promoting sustainable business is critically important work for building modern, resilient companies and supporting a safer, collective future for all of us. We wish you the best in your ongoing work, and if we can be helpful at all, please let us know.