ESG Governance - Definition, Examples & Best Practices

Within ESG, governance (the "G") is an important, and often under-appreciated third pillar.

Corporate governance is the oversight, structures, policies, rules, and controls related to a company's ownership, leadership, processes, and risk management. ESG governance is a type of corporate governance: the governance related to a company's ESG activities, opportunities, controls, and risks

While environmental issues like climate change and social topics like diversity and human rights typically receive more public attention, governance ultimately defines how a company operates when it comes to ESG and other aspects of its business. ESG governance sets structures and guardrails, providing important rules everyone and an organization can follow, like a company-wide Code of Ethical Conduct policy for employees.

When you see a company embroiled in scandal or bad publicity from internal misconduct, it's usually the result of ESG governance failings. When telecom equipment giant Ericsson is investigated for bribery, or the newly Elon Musk-led Twitter experiences layoffs, resignations, and controversy, these reflect their company's governance shortcomings.

Meta (Facebook), WeWork, Theranos, Volkswagen, Exxon Mobil, and FTX are other cautionary, recent examples of companies lacking leadership accountability, oversight, and proper governance controls.

How is ESG Governance Defined?

ESG governance refers to the implementation of decision-making, board oversight, rules, policies, and procedures throughout an organization related to ESG (environment social governance). Organizations with strong ESG governance practices typically have responsible owners and leadership teams, clear ESG accountability structures, and good process controls

ESG governance also encompasses risk management, and is viewed by many investors and analysts as a proxy metric for overall management quality.

Some key topics and themes within ESG governance include:

- Shareholder structure

- Board diversity

- Executive compensation

- Company policies

- Business ethics and conduct

- Tax transparency and strategy

- ESG regulatory compliance

- Risk management

- Anti-competitive practices

- Data protection, privacy, and cybersecurity

- ESG decision-making structure

- ESG data controls

- ESG reporting and disclosure

Typically, when a company wants to 'improve' its ESG governance, it takes constructive steps in one or several of these areas. Using independent, third party auditors and audits, cultivating a more diverse board of directors, implementing data protection measures, improving executive accountability, or drafting, updating, communicating, and training employees on important ESG policies are all examples of ESG governance in action.

Why is ESG Governance Important?

Overall, ESG has become increasingly important as investors, regulators, and customers seek companies that demonstrate sound financial decision-making and business performance while contributing [more] positively to the environment and society.

Companies that implement ESG measures effectively typically show better employee retention and lower involuntary turnover rates. Sustainable brands often price at a premium versus competitors and improve margins. Energy efficiency investments, logistics optimization, and circular business model innovation can also reduce energy use, emissions, and overall operating costs.

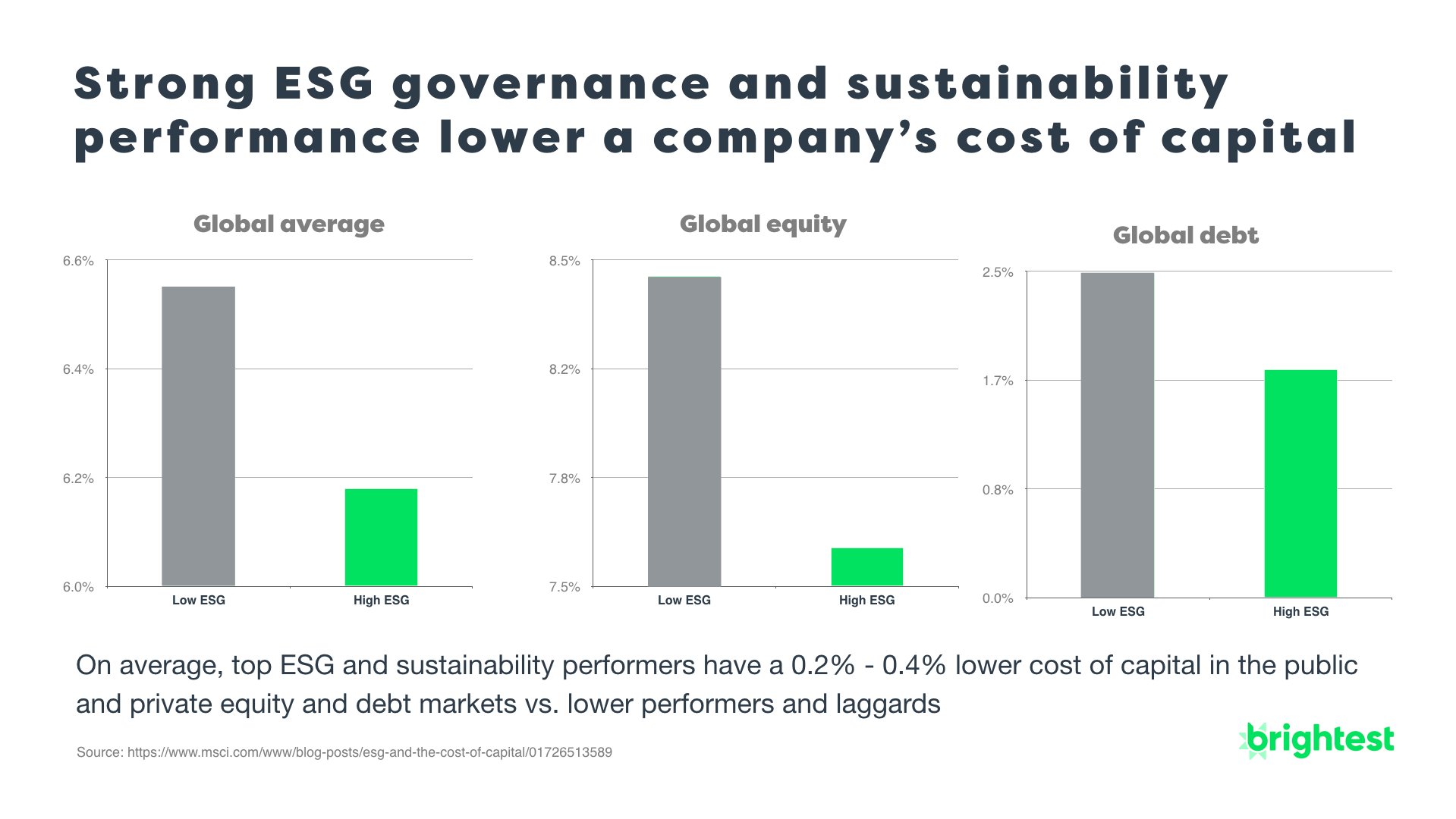

Having strong ESG governance practices go hand in hand with strong business practices. Because corporate governance has been around longer than most environmental and social practices, there’s a lot of historical data, evidence, and research that points to the success and long-term value of sound governance. Research from S&P and MSCI suggests companies with robust governance practices have stronger financial performance, lower cost of capital, and more operational efficiency than their peers with weaker governance practices.

By comparison, poor ESG governance practices often lead to regulatory and reputational risk, corruption, higher cost of capital, reduced shareholder returns, and ineffective decision-making. In an analysis of 4,000 public equities by RobecoSAM, securities with the lowest governance scores, on average, underperformed in the market by 7.8% compared to companies with better governance ratings.

In many consumer industries, certain customer demographics are also advocating for stronger ESG governance. Consumers, especially those under the age of 34, are holding companies to higher ESG standards. According to a 2019 study by Porter Novelli, 93% of Gen Z consumers want to see companies put policies and procedures in place to back up their ESG and other commitments, and 75% say they research the ESG activities of companies they choose to buy or not buy from.

In B2B, many companies are also applying greater ESG scrutiny on who they do business with, and that extends to ESG governance. Here at Brightest, we've seen a large increase in clients sending and responding to ESG and sustainability surveys and supplier assessments related to their ESG business practices.

In addition to understanding a supplier's environmental and social practices, sustainable procurement teams also want to understand how the supplier's company is managed, if there are any governance risks in areas like corruption or bribery, and if there’s a clear culture of transparency, accurate disclosure, and ethical decision making. A large part of ESG supplier vetting requires documentation to support claims and assessment responses. As a result, a company's own ability to maintain up-to-date ESG policies and procedures, centrally manage data and documents, and transparently disclose information are indicators of its overall ESG governance quality.

Across the board, the importance of ESG governance truly can’t be understated.

The Business and Shareholder Benefits of Strong ESG Governance

When it comes to ESG governance, boards, leaders, and investors should view it as both a method of preventing and controling downside risks, as well as a source of opportunity and competitive advantage. For example, multiple recent studies indicate that more independent, diverse, and ESG-oriented boards and leadership teams are positively correlated with overall company profitability and risk mitigation. The same is also true for more diverse, inclusive workforces.

For example:

59%

Of companies report positive top-line impact from operational ESG investment, and more than half of companies noted a positive effect of sustainability improvements on overall company profitability

28%+

A study of 140 US companies by Accenture found that companies who were leaders in diversity hiring, employment, and inclusion achieved, on average, 28% higher revenue, higher net income, and 30% higher profit margins

19%+

Diverse management teams deliver 19% higher revenues from innovation compared to less diverse company leadership

Meanwhile, the downside risks of overlooking sound ESG governance can also be considerable. For example, under the new 2023 ESG supply chain transparency and due diligence laws in Germany, if a company with annual revenues of over €400 million doing business in Germany is found to be in violation, it may have to pay fines up to 2% of its annual revenue. Companies fined more than €175,000 can also be excluded from public contracts in Germany for up to three years. Similarly, IBM puts the average cost of a governance-related corporate data breach or consumer privacy violation at $4.2 million.

Strong ESG governance and controls help de-risk companies' financial exposure to a variety of ESG regulatory, investor, procurement, and process risks.

Brightest's integrated ESG management, governance, and reporting software helps companies track and measure ESG financial risks

What Does Good ESG Governance Look Like?

Governance starts with a strong board, leadership team, and accountability structure. Make sure that your board is made up of diverse members and independent voices who understand ESG. In some US states and European countries, certain board diversity thresholds are a regulatory requirement. Formalize board and committee review of important ESG issues, and frame ESG governance in terms of how it creates and preserves value for shareholders.

Related to ESG governance, it’s also important to evaluate executive compensation, starting with the CEO. Is executive compensation in line with industry standards? Are there any major pay gaps between leadership and other employees? Are there gender or racial pay gaps? Is executive compensation indexed to ESG performance?

Businesses who manage these issues and implement material improvements demonstrate they're committed to ESG governance, and in tune with stakeholder expectations and industry standards.

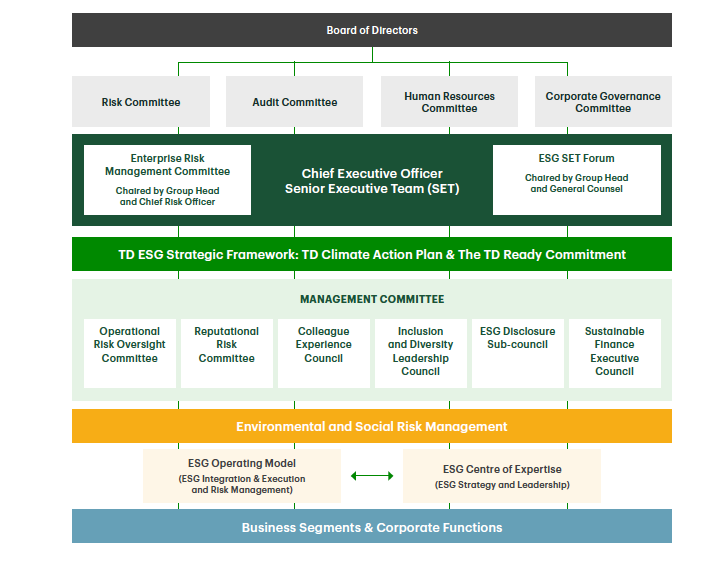

ESG governance structure example. Source: TD Bank

It’s also vital that business practices and processes are governed responsibly. Appropriate teams should regularly review accounting statements and tax policies to make sure they're in line with local and national regulations. Internal and external audits should be conducted, and audit findings should be available for review. Strong risk management policies and practices should be put in place, overseen by experienced, empowered, and accountable leaders.

One of ESG’s main roles is to reduce risk. It’s important for companies to regularly review internal and external ESG risks through respected independent frameworks like TCFD (Task Force for Climate-Related Financial Disclosure), determine strategies to reduce risk(s), and put preventative and adaptive measures in place to manage them accordingly. Make sure your legal and finance teams are educated about ESG.

Additionally, business initiatives must be linked to appropriate policies, procedures, and record-keeping. Make sure ESG documents and data are up-to-date, discoverable in accordance with appropriate access permissions and controls, and protected. It’s also good governance to maintain an easy-to-find, public website page where stakeholders can view your company's ESG policies, documentation, practices, and governance controls.

ESG Governance Metrics and KPIs

ESG KPIs should reflect a company's strategy, goals, business model, value chain, and purpose. KPIs should also connect the dots between ESG standards, stakeholders, regulatory obligations, and investor relations needs.

Common ESG governance KPIs companies should be tracking include:

- Board diversity

- Board ESG experience and subject-matter expertise

- Management training % in ethics, anticorruption, and other key ESG areas

- Executive compensation levels and CEO pay ratios (ideally tied to ESG performance)

- ESG-related compliance incidents, penalties, and remediation

- ESG-related litigation incidents and remediation

- Cybersecurity incidents, risk management, and remediation

- Financial costs and projected exposure associated with ESG risks

Make sure to select ESG governance KPIs that are material and relevant to your company. When ESG KPIs aren't material (and then get communicated publicly) it raises the risk of provoking external criticism for "greenwashing" or being insincere. The more your ESG initiatives and communication efforts focus on material governance controls, metrics, and reporting, the stronger your ESG reputation will be.

Similarly, rather than trying to boil the ocean or appease everyone, focus on doing (and measuring) a few specific KPIs well, then build from there.

ESG Data Governance and Controls

Most ESG professionals understand the relationship between strategy, actions, impact, data, and outcomes. The challenge is creating a consistent process to efficiently get the data you need to measure results, report on success, and reaffirm business performance. The reality is most ESG professionals we know spend way too much time gathering and organizing data. Yes, we need the right data to track our KPIs and create reporting, but we shouldn't spend all our time on that when there are many opportunities for efficiencies.

The more you simplify, centralize, and streamline your data collection, management, and business intelligence capacity (while also implementing sound governance controls), the better decisions you'll be able to make about operational ESG performance, and the more time you'll have to focus on ESG implementation and improvement, rather than just reporting.

In our experience, a system like Brightest can save and automate hours of ESG data work per week to unblock valuable team time and productivity.

Your Next Steps With ESG Governance

As ESG continues to grow in executive mindshare and compliance importance, it’s critical for modern businesses to keep good governance practices as a focal point and executive priority. It may be helpful to find a governance champion who can be in charge of keeping an organization’s governance practices in order. There can be lots of policies to track, review, and implement across different corporate departments like finance, HR, and IT. With stakeholder demands increasing for strong governance practices, organizations need to stay on top of their obligations and risks.

Additionally, ESG governance also places a key role in voluntary and mandatory ESG reporting and public disclosure.

Effectively understanding and communicating ESG results and outcomes to stakeholders remains one of the most important responsibilities for any ESG team. Your ESG reporting strategy and governance approach should be closely tied to your communications strategy: where, when, how, and why are you authentically telling your brand's ESG narrative? All the pieces need to fit together.

There are a lot of potential channels for ESG storytelling if and when you have the data and results to back it up, including internal communications, annual reports, websites, social media, press, and ESG ratings providers. Where is your company focusing its attention and resources? Do your ESG governance controls support your organization's ability to achieve the outcomes its pursuing (or claiming) while managing the related processes and risks?

Yet again, many of these themes highlight the overall importance of good ESG governance.

Wherever you are in your ESG governance roadmap, we wish you all the best as you continue making (and measuring) positive impact. If we can be helpful at all (at any step in your process), please get in touch. A central part of our mission here at Brightest is enabling better, data-driven ESG governance and decision-making for companies around the world.