ESG Investor Relations - How to Manage ESG Analysts, Discloure & Reporting

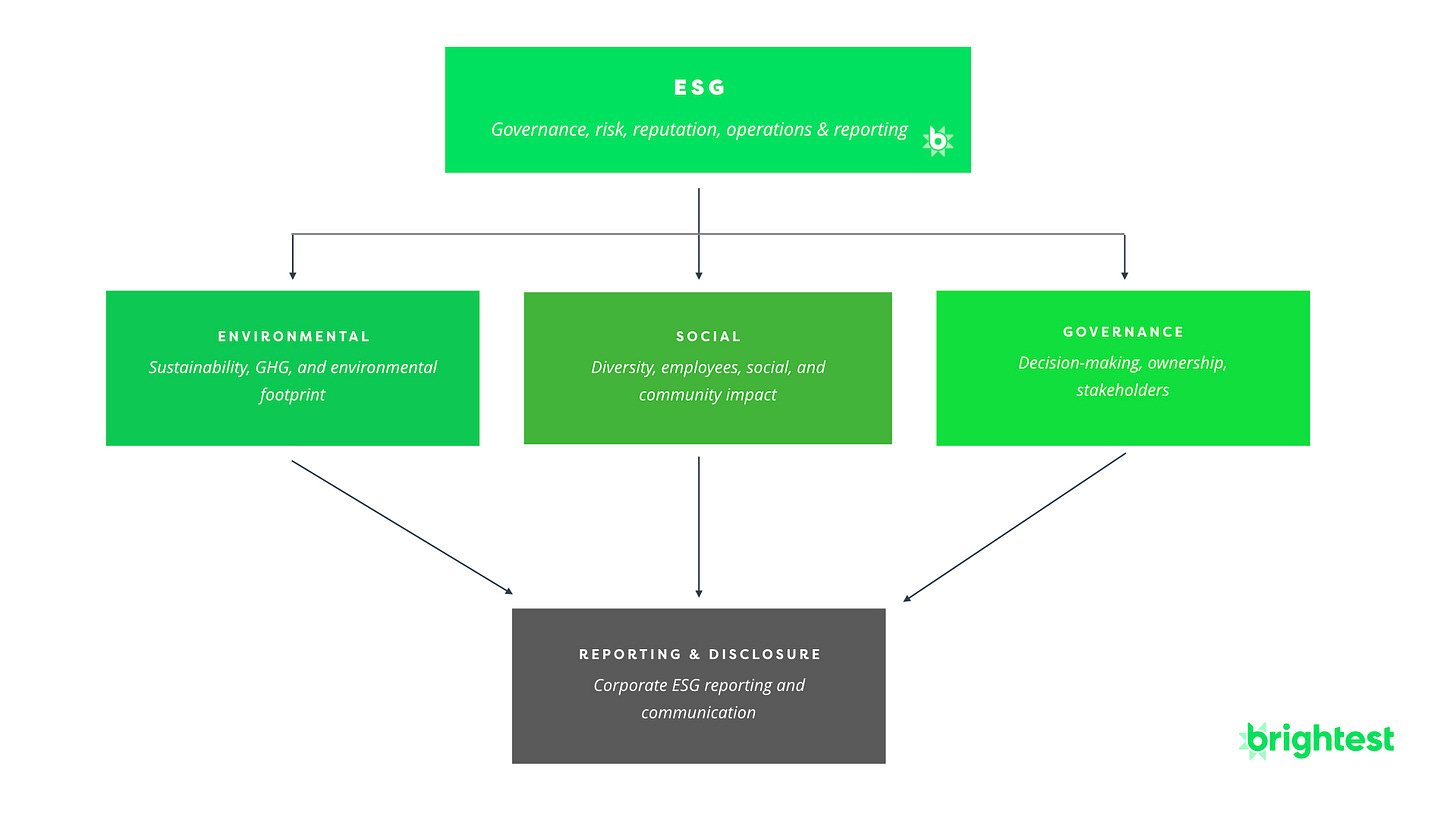

Today, most public companies have committed to managing, improving, and disclosing their environmental, social, and governance (ESG) performance as a core part of their investor relations strategy. Growing scrutiny and due diligence from investors, analysts, banks, regulators, and customers has made ESG a key responsibility in modern investor relations.

In an era of climate change, global conflict, economic uncertainty, and social inequality, ESG has become one of the most important trends in capital allocation, risk management, and corporate share performance - trends investor relations teams need to be mindful of.

- Why is ESG so important for investor relations

- ESG investor relations strategy

- What are the key ESG responsibilities for an investor relations team?

- Why investors want ESG disclosures

- The different types and categories of ESG investor risk

- ESG investment risk examples

- How should investor relations manage ESG

Why is ESG so Important for Investor Relations?

Environmental, social, and governance (ESG) factors are important for corporate investor relations because they can have a significant impact on a company's financial performance and risk profile. In 2022, over 80% of institutional investors, particularly ones focused on sustainable and responsible investing, consider ESG factors when making investment decisions. This is because ESG factors can provide insight into a company's management practices, business model, and overall sustainability, which can affect its long-term financial prospects and shareholder returns.

ESG investor risk refers to potential financial losses or negative impacts that can result from investing in companies, assets, or industries that do not align with environmental, social, and governance (ESG) principles and market trends. This can include risks such as reputational damage, corporate governance failings, regulatory changes, climate risk, and shifts in consumer demand toward more sustainable products and services.

For example, a company that has strong ESG practices may be seen as more likely to have stable and sustainable revenue streams, as well as a lower risk of regulatory or reputational issues. In contrast, a company with poor ESG practices may face increased regulatory scrutiny, reputational damage, and financial risks, such as legal liabilities and supply chain disruptions.

As a result, many companies are increasingly prioritizing ESG considerations in their investor relations efforts, including:

- Responding to ESG analyst questionnaires (like the S&P CSA / Dow Jones Sustainability Index)

- Providing regular reporting on their ESG performance

- Performing and disclosing ESG materiality assessments

- Engaging with various investors, analysts, and stakeholders on ESG topics and issues

By doing so, companies demonstrate their commitment to sustainability and responsible business practices, which can help to build trust with investors and enhance their market reputation.

While ESG focuses on "non-financial" performance indicators compared to classic investor metrics like profit and earnings-per-share, ESG issues increasingly have material, financial impact on a company's access to capital, operating costs, and long-term competitive standing. ESG criteria give investors a holistic risk lens to evaluate a business or investment's key ESG-related risks.

ESG analyst scores and investment ratings are designed to capture and reflect an investment's ESG risk profile.

ESG Investor Relations Strategy

Investor relations is an important internal stakeholder in a company's overall ESG management and strategy. In some cases, investor relations is the department that's directly responsible for preparing, reviewing, and releasing ESG reports and disclosures. In other cases, investor relations is working alongside a separate ESG or sustainability department to support their work from an investor-facing perspective.

When it comes to ESG and investor relations, it's important to consider the overall strategic goal(s) of your ESG reporting, disclosure, and implementation programs.

Are you looking to de-risk specific shareholder relationships or proxy actions? Attract new ESG-oriented investors? Improve shareholder perception? Increase your analyst ESG ratings score(s)? Make it more efficient to manage all the different shareholder disclosure requests and surveys you receive?

It's important to have a vision and sense of what your organization wants to accomplish with its ESG investor relations activities. For example, if your company's publicly-listed, review your top institutional shareholders. What are their ESG portfolio criteria and methodology? Are there any dedicated ESG strategy funds? What ESG issues are they focused on?

Many larger institutional investors and fund managers like BlackRock, State Street, Fidelity, Vanguard and others post public information on their websites about their ESG criteria, voting approaches, and investment expectations. ESG analysts like S&P, MSCI Sustainalytics, and ISS do as well. Be sure to review and familiarize yourself with that information.

Once you're clear on your shareholders and strategy, then you can turn to reporting, disclosure, and other key responsibilities.

What are the Key ESG Responsibilities for an Investor Relations Team?

As the team responsible for building and maintaining relationships and sharing information with investors and analysts, investor relations carries important ESG reponsibilities. While exact reponsibilities vary from company to company, generally an IR team will be responsible for:

- Communicating the company's ESG policies and practices to investors and analysts, including any goals or targets related to sustainability and social responsibility

- Assisting with the analysis, consideration, and implementation of ESG reporting frameworks, such as the Task Force for Climate-Related Financial Disclosure (TCFD) or the Sustainability Accounting Standards Board (SASB)

- Participating in investor meetings and conference calls to discuss the company's ESG performance and strategies

- Responding to investor and analyst inquiries about the company's ESG practices and policies

- Participating in industry initiatives or working groups focused on ESG issues

- Assisting with the preparation of materials for shareholder meetings, including proxy statements and shareholder proposals related to ESG issues

Typically, the largest commitment of an investor relations team's time and resources will likely be devoted to ESG reporting and disclosure itself.

An ESG report is a communication and disclosure tool designed to increase corporate transparency about an organization’s ESG performance, risks, and opportunities. ESG reports should be clear, data-driven (rather than vague, anecdotal, or solely qualitative), authentic (not greenwashing, spin, or misrepresentation), and tell a clear story about how the company is pursuing better social, environmental, and equitable outcomes for its employees, customers, external communities, and the planet, backed by evidence.

Why Investors Want ESG Disclosures

In most countries, ESG reports are voluntary, not mandatory. However, recent 2022 and 2023 legal changes, announcements, and impending mandates in the United States, Canada, European Union (EU), United Kingdom, Singapore, and other regions are creating stricter disclosure obligations for many types or organizations -- particularly publicly-listed companies -- to measure, report, and disclose their ESG performance.

ESG reports and disclosure are important in investor relations because they're used by ESG ratings and analyst firms to calculate a company's ESG investment rating. Then, in turn, institutional investors factor those ESG ratings and scores into their investment decisions. As a result, improving their company's ESG analyst ratings and rankings is an important priority for many investor relations teams.

Investors principally want ESG data, disclosures, and rankings because they want to consider the full picture when it comes to investment risk. ESG investment risk is important to investors because it lets them assess information about a company's performance in areas that matter for overall investor returns, but may not be included in a company's traditional financial reporting or an asset's capital profile, such as its environmental impact, worker human rights and safety, and governance competency.

Exxon Mobil, Meta (Facebook), Twitter, Tesla, WeWork, Theranos, Volkswagen, Wells Fargo, and FTX are all cautionary, recent examples of companies whose share price and investor returns have been significantly influenced by ESG risk factors.

Different Types and Categories of ESG Investor Risk

For companies and other investments, there are five primary types of ESG investor risk:

1. Reputational risk: Companies that fail to properly manage their ESG risks may face negative public perception and reputational damage, leading to loss of customer trust and loyalty. When a company lacks robust ESG controls, actions, and disclosures, it's often viewed as not being "forward-looking" or "risk-conscious", which can hurt public brand perception and investment value.

2. Direct ESG financial risk: ESG risks can have significant financial implications for companies. For example, failure to properly manage environmental risks may result in regulatory fines or costly lawsuits. Labor violations, product recalls, or supply chain shortages can lead to lost sales, revenue, and customers.

3. Economic transition risk: Climate and biodiversity risk are both critical ESG focus themes today for companies, investors, and governments. As the world adapts to the impacts of climate change and transitions to a lower-carbon economy, assets and organizations that fail to adapt face long-term devaluation risk. Fossil fuel companies and assets, as well as companies that ignore important strategic trends like circular economy will be at a fundamental competitive and access-to-capital disadvantage long-term unless they adapt immediately. By comparison, companies that effectively manage their ESG risks will gain a competitive advantage over their peers and attract investors who prioritize ESG performance.

4. Legal and regulatory risk: Companies and investors that fail to properly manage their ESG risks may face legal action and penalties from regulators or other stakeholders. In the United States, the SEC (Securities and Exchange Commission) announced a plan in March 2022 called "The Enhancement and Standardization of Climate-Related Disclosures for Investors." The SEC's new climate disclosure framework will introduce mandatory climate risk reporting requirements for registered companies. In Europe, the Corporate Sustainability Reporting Directive (CSRD) is an upcoming set of EU sustainability reporting rules designed to make corporate sustainability reporting more standardized like financial accounting and reporting. Other countries and stock exchange operators, including Australia, Canada, Singapore, and the United Kingdom are also broadening climate risk rules for large companies, ESG investment funds, and financial institutions.

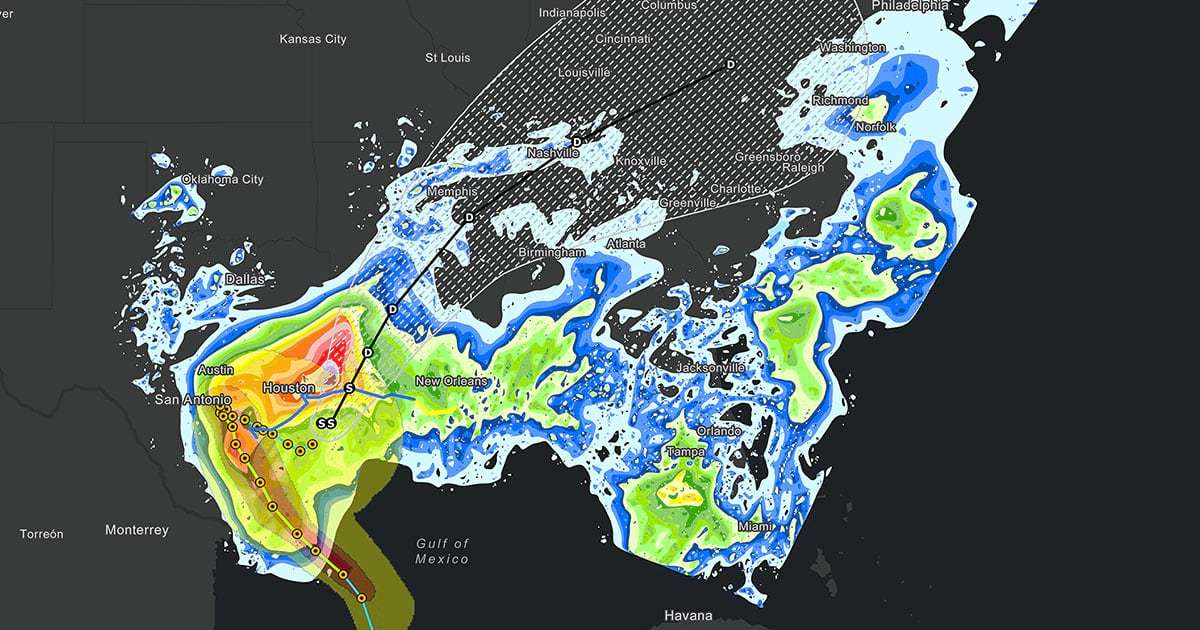

5. Acute physical risk: Many companies and assets are also exposed to acute physical risk, both directly and in their supply chains. For example, an insurance company might insure property near the ocean in a region where climate change is scientifically proven to increase storms and raise sea levels. Since climate change increases the risk those homes or buildings suffer weather damage, climate change creates material financial risk for that business which needs to be managed. A company that sources crops and food ingredients from a region prone to draughts, heat waves, or flooding due to climate change is also exposed to ESG risk.

In total, Fortune 500 companies carry an estimated $2 trillion+ in financial risk from climate impacts alone, based on outside-in analysis and company ESG reporting. The overall ESG risk exposure of the global economy is even larger.

ESG investment risk is also very company and asset-specific. Some companies have high ESG investor risk due to factors like their industry (examples: fossil fuel, mining, fast fashion), geographic location(s), corporate leadership and governance, business practices, or other areas. It's important for investors to perform their own materiality research and due diligence when assessing a company's ESG risk.

How to Reduce and Manage ESG Investor Risk

There are several steps investor relations teams can take to reduce their company's ESG investment risk profile:

- Conduct a thorough ESG materiality and risk assessment: This involves researching and evaluating the potential environmental, social, and governance (ESG) risks associated with the company's operations, products, and services. This assessment can help identify potential ESG risks and help the company take action to mitigate them. For more on ESG materiality, please read our guide here. Or feel free to contact us directly for materiality help or questions.

- Develop an ESG risk management plan: This plan should outline the steps the company will take to manage and reduce its ESG risks. This can include implementing new ESG policies, initiatives, and procedures, investing in new technologies, divesting from high-risk ESG investments, or engaging with stakeholder groups to better understand and address ESG concerns.

- Consider TCFD: The Task Force on Climate-related Financial Disclosures (TCFD) has become one of the global standard frameworks in the United States, UK, and EU for communicating climate-related investor risk. If you’re a startup or company approaching an IPO, use TCFD to establish and communicate your core climate risks, risk management strategic, goals, and KPIs.

- Engage with stakeholders and investors: Actively listen to and engage with your company's key ESG stakeholders, including customers, employees, and investors, to better understand their concerns and priorities. This can help a company identify and address potential ESG risks and improve its overall ESG performance. Investor perspective on ESG risk is particularly important. We always recommend engaging investors during your materiality assessment, even if you're a private company. If your company is publicly-listed, review your top institutional shareholders. What are their ESG portfolio criteria and methodology? Are there any dedicated ESG strategy funds? What ESG issues are they focused on? Many larger institutional investors and fund managers like BlackRock, State Street, Fidelity, Vanguard and others post public information on their websites about their ESG criteria, voting approaches, and investment expectations. Be sure to review and familiarize yourself with that information.

- Invest in sustainability initiatives: Invest in projects and initiatives related to renewable energy, reducing waste and emissions, and implementing more sustainable business practices. These initiatives can help the company reduce its ESG risk profile and improve its overall sustainability performance and perception.

- Monitor and report on ESG performance: This involves regularly tracking and reporting on the company's ESG performance, including its progress in reducing ESG risks and improving sustainability. This can help the company identify areas for improvement and take action to reduce its ESG risks over time.

ESG risk management is a firm-wide, cross-disciplinary approach that starts from the top. It's critical that a company's board and C-suite are engaged in evaluating, assessing, and managing ESG risks, as well as allocating resources toward addressing them. If that's not happening, investor relations leadership needs to advocate for it and push the agenda.

Prioritizing ESG in Investor Relations

Compared to quarterly earnings cycles and other investor relations responsibilities, ESG often requires a longer-term lens on corporate strategy and risk. But ESG also carries near-term, immediate consequences, particularly for companies who fail to consider and address material ESG considerations.

In particular, effective vs. ineffective ESG investor relations has implications for:

- Access to capital - From institutional ESG investors like BlackRock and State Street to private equity and banking lenders, more capital providers are using ESG indices, scores, and ratings signals to assess the risk-return profile of their allocation decisions. Emerging evidence suggests better ESG performance translates to a lower cost of capital for companies, plus broader liquidity access

- Share price risk - Research from MSCI and Morgan Stanley indicate strong ESG performers have lower earnings volatility and lower market risk compared to lower-ranking companies

- Board risk - From Engine No. 1's Exxon Mobil board activism campaign to State Street voting against the re-election of directors at 400 companies who failed to improve gender diversity on their all-male boards, directors who fail to act on material ESG risks and opportunities are increasingly seen as poor fiduciaries

- Climate risk - As climate change and biodiversity loss fuel trillions of dollars in economic loss and risk, organizations need to identify, manage, and adapt to climate impacts across their business model, products, and value chain. Fortune 500 companies alone carry an estimated $2 trillion+ in financial risk from climate impacts

- Regulatory risk - On the legal side, regulators in the European Union (EU), United Kingdom (UK), United States, Canada, Singapore, and other regions are pushing for more robust ESG implementation across financial reporting, non-financial reporting, and regular operational practices. The Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting System (ESRS) require thousands of companies doing business in the EU to improve their sustainability performance and ESG disclosures

- Brand and customer risk - The majority of consumers (and a growing number of businesses) want to buy from sustainable brands, making ESG investment, integration, and innovation important ways to de-risk current and future revenue streams while strengthening public reputation

- Financial ROI - There are many, proven ways sustainability and ESG integration can drive operational cost savings and tangible ROI for category leaders

In many ways, ESG performance has become a proxy for responsible management quality, brand reputation, and macroeconomic risk management. A well-run company that cares about its people, customers, and the environment will logically be more resilient over time and outperform its peers who don't.

The Long-Term Importance of ESG in Investor Relations

Overall, ESG considerations are an important factor for investors in evaluating a company and its performance. That makes ESG a central responsibility for investor relations teams and leaders. There are dozens of case studies demonstrating how strong, thoughtful, and strategic ESG risk management and governance are competitive business advantages that deliver positive ROI and shareholder value, and it's important for IR teams to be the stewards of that narrative.

Many companies start their ESG investor relations work due to compliance and investor reporting pressures, only to find that as their ESG investments, maturity, and capabilities evolve, they realize significant cross-company benefits and efficiencies.

Every company's ESG roadmap is different - and ESG investor relations is a long-term, strategic communications avenue for boards, management teams, and IR leadership. Nonetheless, the benefits of strong ESG investor relations on brand reputation, employee talent attraction and retention, culture, operational efficiency, risk management, and access to capital are not only numerous - many are quantifiable. And, as always, if we can help your organization enhance the effectiveness of its ESG investor relations and reporting efficiency, please be in touch.