ESG Metrics Guide - Last Updated: December 20, 2022

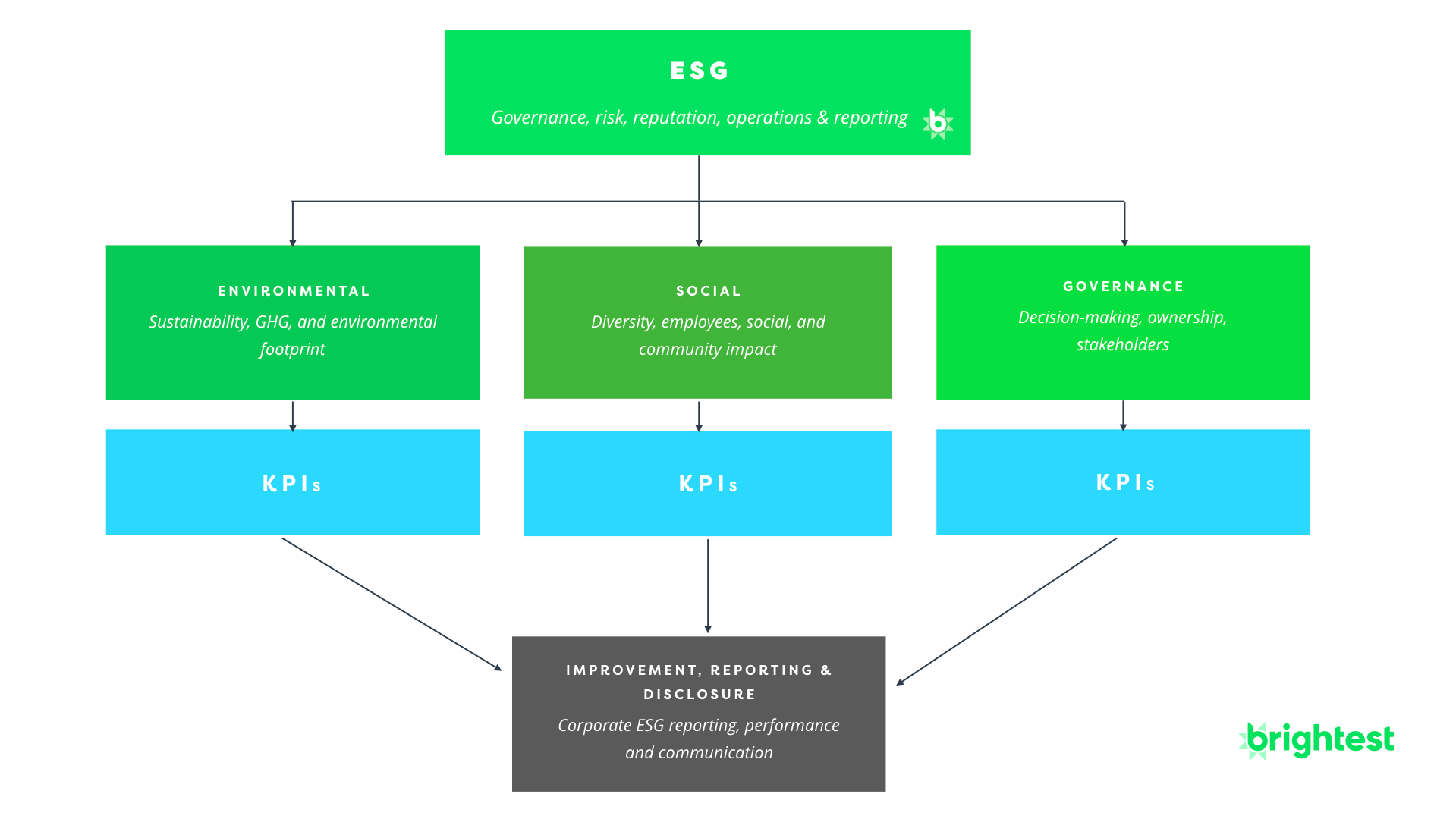

Measuring a company or investment's ESG (environmental social governance) performance and risks can be complex. ESG incorporates a wide range of ESG metrics and indicators around an entity's leadership, policies and controls, sustainability, diversity, safety, risk management, social impact, and more. So what are the most important ESG metrics? And why do they increasingly matter for companies, investors, and corporate leaders?

What is an ESG metric?

A metric is a quantitative or qualitative indicator used to track progress and measure success. In business, metrics are used by leaders, managers, analytics teams, and other decision-makers to understand how their company is performing against specific plans, targets, or industry benchmarks. The most important metrics are often called KPIs, or key performance indicators.

For example, common business metrics include indicators like:

- Total revenue or turnover

- Profit margin (%)

- Operating gain or loss

- Total employee headcount

Within ESG:

ESG metrics are indicators of a company's overall performance and risk profile across important environmental (E), social (S), and governance (G) criteria

ESG metrics can be based on ESG and sustainability reporting standards, ESG rating frameworks from investors or analysts, or regulations like the European Union's Corporate Sustainability Reporting Directive (CSRD).

ESG KPIs and metrics are used by:

- Companies to track their ESG progress and performance

- Investors and analysts to gauge a company’s ESG score, ranking, and risk profile

ESG metrics are used to determine a company's strategic and operational ESG achievements, as well as ESG risks and opportunities related to its industry, business model, and value chain.

ESG metrics are especially useful for comparing and benchmarking one company compared to other businesses within the same sector.

In most cases, strong ESG metric performance, corporate success, and value creation go hand-in-hand. For example, companies with strong ESG rating performance typically have a lower cost of capital compared to ESG laggards. As a business leader, using ESG metrics to make a strong business case for your company's ESG performance backed up with compelling, data-based storytelling is the best way to win ESG executive buy-in and positive external favorability with ESG investors, customers, regulators, and other stakeholders.

Common ESG metrics and indicators

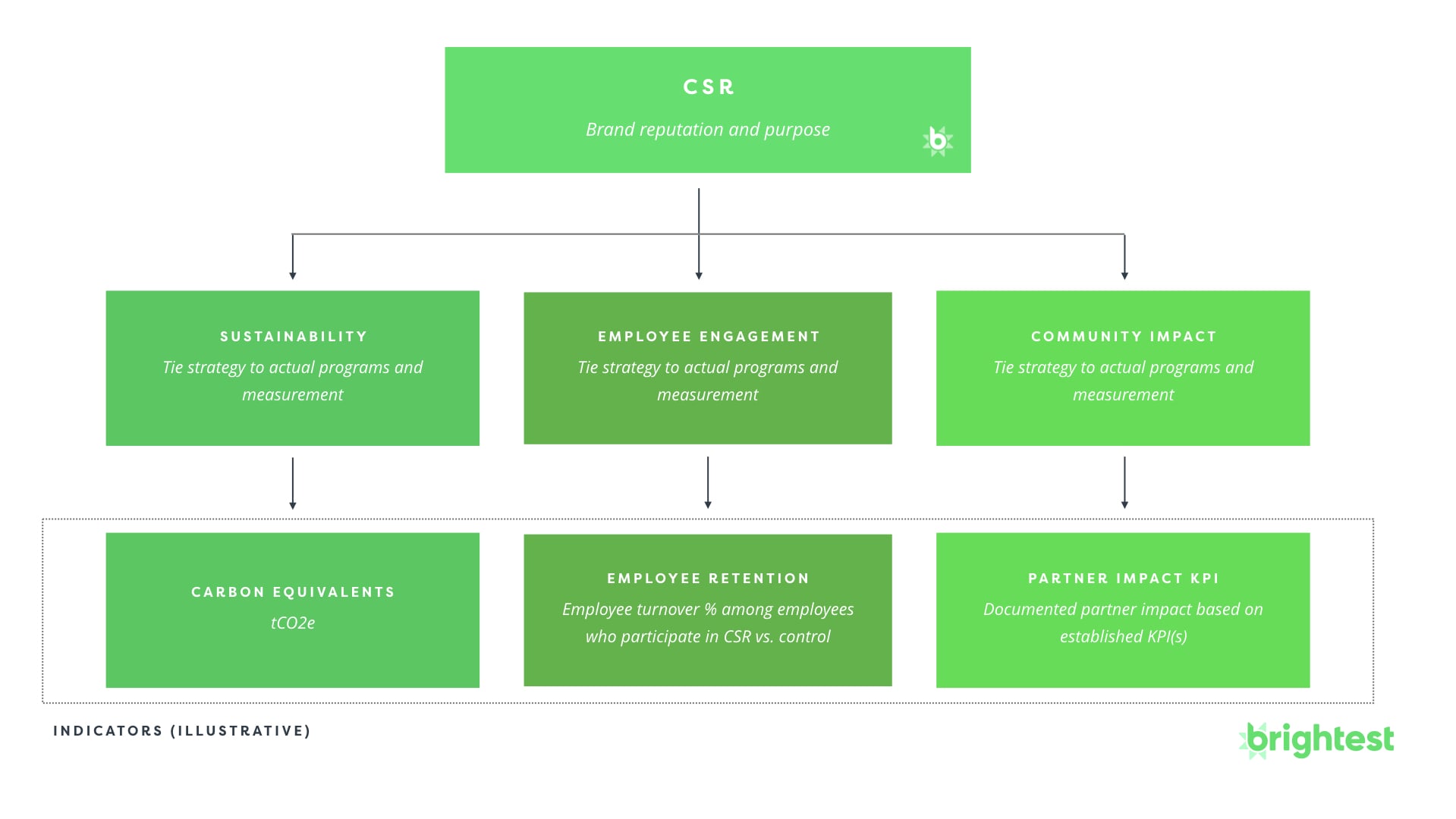

In practice, ESG is pursued, implemented, and tracked by different departments and teams inside a company. HR might lead work and measurement on ESG social metrics, while the procurement department focuses on ESG metrics related to the company's supply chain.

Each ESG team, theme, and initiative should have or tie back to a clear, measurable set of ESG metrics. In some areas, these indicators are fairly clear cut. For example, in environmental sustainability, measuring greenhouse gas (GHG) emisisons in Scope 1, 2 & 3 CO2 equivalents (CO2e) generated from operations is an established indicator for companies across industries. Similarly, ESG social metrics like management and employee diversity are also straightforward to quantify.

In other areas however, such as climate risk management or ESG corporate governance, ESG metrics may need to be more qualitative.

That said, we generally recommend a company design and set ESG metrics in these business areas:

- Carbon Footprint Reduction - One of the your company's most important ESG metrics is its greenhouse gas (GHG) emissions footprint. If you haven't already, measuring the company's baseline should be a top priority for your sustainability team, then setting a thoughtful emissions reduction target

- Energy and Water Efficiency - Depending on your business model and value chain, your energy and/or water footprint may be a sigificant and material ESG metric, both financially and in terms of its environmental impacts. Again, measuring baselines and setting energy efficiency and water (and wastewater) reduction targets should be a key metric within your overall ESG strategy. Often, energy efficiency and water improvements are some of the highest ROI capex investments a company can make within ESG

- Employee Health and Safety (EHS) - Most companies - particularly manufacturing and product-centric businesses - know how operationally important EHS is in the context of the organization's overall success and risk management. Make sure to take that a step further and not only measure operational EHS metrics, but also key culture and employee wellness ESG metrics like employee satisfaction, engagement, and retention, peer satisfaction, work environment quality, fair compensation, and other key indicators about the health, motivation, and resilience of your people

- Diversity, Equity, Inclusion, and Belonging (DEI&B) - Make sure to not only collect data, but set clear ESG metrics, policies, targets, and ecosystem support as an organization to champion, promote, and resource DEI&B. Go beyond general diversity pie charts and consider setting ESG metrics and targets around applicant and hiring diversity, management diversity, board diversity, supplier diversity, or employee resource group (ERG) involvement. It's critical for your business to not only measure diversity in hiring, but also promote it culturally in terms of career advancement, representation, engagement, and employee retention

- Product Quality, Sustainability, and Safety - Product safety and sustainability play incredibly important roles in building customer (and investor) trust. Have you performed a lifecycle assessment (LCA) for your top products? Do you have metrics and targets for responsible sourcing? Have you set up KPIs and targets around product quality, safety, and durability? What about end-of-life treatment of your products? Are there opportunities for recycling, re-use, and/or circularity? Product can be one of the most material places to connect your organization's ESG strategy with operational execution and innovation

While individual departments may be responsible for specific ESG metrics and measurement areas, it's important for CEOs, CFOs, and ESG leaders to create a unified, company-wide analytics approach. In order for ESG to really drive business benefits, competitive advantages, and social impact, it must be part of the company's top-level strategy, supported by the C-suite, and adopted across the organization.

You can't delegate ESG or company purpose to a single department

Top ESG metrics - examples and recommended starter KPIs

There are dozens of different potential ESG metrics. To keep things simple and focused on what really matters, we recommend starting with an ESG metrics tracking framework that resembles the table below: a few key, mostly quantitative indicators across E, S, and G.

Here's an example corporate ESG metric framework:

| Environmental | Social | Governance |

|---|---|---|

GHG emissions Scope 1, 2 & 3 GHG emissions measured in mtCO2e | Diversity Percentage of gender and ethnic identity representation for management and employees | Board diversity Percentage of gender and ethnic identity representation for the company's board of directors |

Energy management and intensity Total energy consumption vs. the % of energy from renewable sources | Work-related injuries The total # of work-related injuries per X number of hours worked | ESG risk incidents # of ESG risk incidents by type, the monetary cost or loss of related penalties, and any resolution/mitigation steps |

Waste management Total weight of waste and % diverted or re-used | Employee turnover Percentage rate of employee turnover and voluntary vs. involuntary comparison | Executive compensation Ratio of CEO compensation to median for all employees |

Water management Total volume of water and % diverted or re-used | Employee engagement Percentage of employees who respond to an annual, quarterly, or monthly employee survey | ESG policy development and adherence The # of ESG policies implemented and the percentage of employees (or partners) trained and following to those policies |

Start by identifying the material ESG issues that matter most to your organization's ESG, operating, and financial performance. Then, cross-reference those areas against leading regulatory requirements, investor ratings metrics, and trusted third-party ESG standards or frameworks. Use that as guidance to decide which specific ESG metrics make the most sense for your organization.

What defines a good or high quality ESG metric?

ESG metrics need to be material and relevant. When we say 'material', we mean both financially or operationally material and aligned with an organization's material ESG themes, topics, and issues assessed through a ESG materiality study or survey.

For example, employee volunteering participation could be a meaningful metric for employee engagement, but likely not for broader social impact or ESG performance (by itself at least), as there are likely better ways your organization can help vulnerable communities or give back. When ESG metrics aren't material (and then get communicated publicly) it raises the risk of provoking external criticism for greenwashing or being insincere. The more your programs and communication efforts focus on material change (and indicators), the better your reputational, brand, and business-related ESG performance will be.

Similarly, rather than trying to boil the ocean or appease everyone, focus on doing (and measuring) a few specific things well, then build from there.

High quality ESG metrics should be:

- Material: They should be relevant to the organization or investment and have a meaningful impact on stakeholders

- Verifiable: They should be based on reliable and verifiable data

- Comparable: They should be standardized and comparable across organizations or investments to allow for meaningful comparisons

- Transparent: They should be clearly defined and disclosed in a way that is easily understood by stakeholders

- Consistent: They should be consistent over time to allow for tracking of progress and comparison to benchmarks

- Actionable: They should be used to drive positive change and be tied to specific goals or targets

ESG metrics and internal ESG data management capabilities

As the old saying goes, you can't improve what you don't understand or have the ability to measure. If your company doesn't strong ESG data management, analytics, and tracking capabilities for your top ESG metrics, you need to work with IT, operations, and other internal data stakeholders to set them up. Many traditional supply chain management systems, ERPs, and databases aren't designed for sustainability reporting or ESG metrics, so make sure you take that into account, or use a dedicated ESG data platform like Brightest.

Define and agree on your key ESG metrics and data sources early on in the process, and be sure to audit and come up with solutions to fill gaps. Find the right balance between your internal goals and science-based sustainability targets, global ESG reporting standards, ESG ratings firms, supplier surveys, and trusted third party advice to determine what to measure (and how).

Most ESG professionals understand the relationship between strategy, operations, data, and reporting. The challenge is creating a consistent process to efficiently get the data you need to measure results, report on success, and reinforce the positive transformation ESG can have across your business. Make sure you have a way to get the underlying data you need to track each ESG metric and indicator.

Need a unified system to track all your ESG metrics, targets, and reporting?

Brightest helps hundreds of companies around the world prioritize, manage, measure, report, and improve their ESG performance, ratings, and reputation

The more you simplify, centralize, and streamline your ESG data collection and management process, the more time you'll have to focus on program work, affirming your outcomes, and celebrating success.

And remember, your investors, suppliers, non-profit partners, and other stakeholder organizations often have significant expertise and perspective related to specific ESG areas. Make sure to schedule ongoing check-ins and impact measurement surveys to collect the underlying impact and performance insights you need for the social side of your ESG reporting. External ESG stakeholder data is important too.

Closing the loop between ESG metrics, reporting, and improvement

Effectively understanding and communicating ESG metrics, results, and outcomes to management and external stakeholders is one of the most important responsibilities of any ESG professional. Your ESG metrics and reporting strategy should be closely tied to your company's overall ESG strategic plan and narrative. What is your firm's ESG north star? Where, when, how, and why are you telling your brand's ESG story? All the pieces need to fit together.

There are a lot of potential channels for ESG metrics disclosure: internal communications, annual reports, websites, social media, press, ESG ratings providers - where are you focusing? And do your ESG metrics provide credible proof your organization's achieving the impact and outcomes its pursuing (or claiming)?

Make sure to work closely with other teams like legal, corporate communications, audit, investor relations, and corporate affairs in this area.

Wherever you are in your ESG metrics and measurement roadmap, ESG is a journey, and we wish you all the best as you continue making (and measuring) your progress and impact. If we can be helpful at all (at any step in your process), please get in touch. A central part of our mission here at Brightest is enabling better data-driven decision-making (not to mention actions and communication) for good.