How to Implement Corporate Sustainability & ESG Reporting - This Week in Sustainability

An environmental social governance (ESG) report is a non-financial disclosure report published by a company or organization about its ESG performance, impacts, accounting, and future plans. ESG reports are typically released annually and made publicly available on a company’s website so it can be reviewed by external stakeholders like investors, customers, and partners. Today, thousands of companies in every sector track, measure, and report on their ESG performance.

An ESG report will typically address business-related topics and themes related to:

What is an ESG Report?

An ESG report is a communication and disclosure tool designed to increase corporate transparency about an organization’s ESG performance, risks, and opportunities. ESG reports should be clear, data-driven (rather than vague, anecdotal, or solely qualitative), authentic (not greenwashing, spin, or misrepresentation), and tell a clear story about how the company is pursuing better social, environmental, and equitable outcomes for its employees, customers, external communities, and the planet, backed by evidence.

ESG reports are typically published by the ESG, investor relations, or corporate affairs department of a company, and creating ESG reports is a collaborative, cross-functional effort.

In most countries, ESG reports are voluntary, not mandatory. However, recent 2022 and 2023 legal changes, announcements, and impending mandates in the United States, Canada, European Union (EU), United Kingdom, Singapore, and other regions are creating stricter disclosure obligations for many types or organizations -- particularly publicly-listed companies -- to measure, report, and disclose their ESG performance.

Moreover, many investors and large companies - including Walmart, Disney, and Amazon - are increasingly asking their investments, vendors, suppliers, and partners to complete ESG and sustainability commitments and disclosures. Employees, customers, and communities are also increasingly likely to advocate for larger and more impactful ESG commitments from companies.

In addition to stakeholder pressure, there's growing evidence and research that indicates high-performing ESG companies are more profitable, have better brand favorability, are better equipped to manage risk, and generate higher shareholder value on average vs. poor ESG performers.

So whether you’re an organization that’s already creating and disclosing ESG and/or sustainability reporting, or a company that’s new to annual ESG, sustainability, or impact reporting, how should you approach ESG disclosure?

ESG Strategy and Organizational Maturity

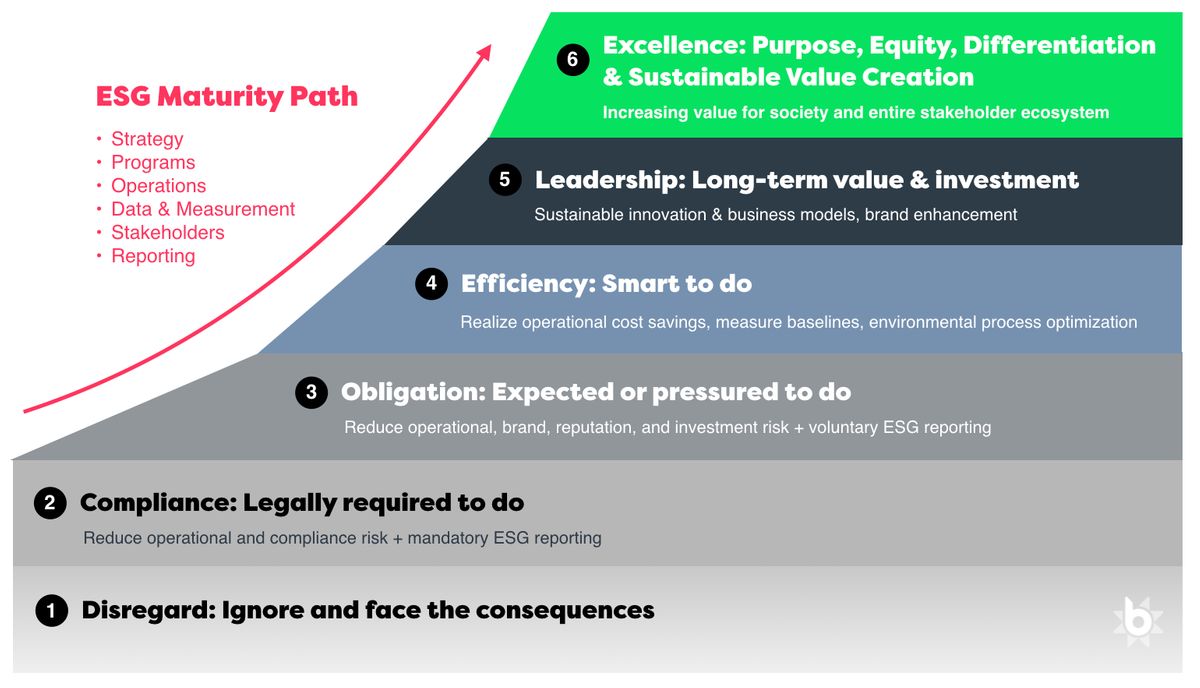

Before we walk through ESG reporting and strategy alignment step-by-step, it's important to recognize every organization follows a different path to building ESG capabilities and maturity. Most companies start with mandatory compliance and reporting, such as complying with Corporate Sustainability Reporting Directive (CSRD) disclosures in Europe, or Calfornia state laws around board-level diversity and inclusion.

From there, ESG is a progression past legal requirements and peer pressure toward culture improvements, operational efficiency, sustainability, innovation, and trust-building.

By definition, every company can't be an ESG leader - and doesn't necessarily need to be. What matters is recognizing where your organization is on the ESG maturity curve, then taking the steps internally and externally to align your strategy, targets, and performance with material ESG initiatives, improvements, and tranparent reporting.

ESG Reporting - Strategy, Materiality, and Organizational Alignment

Logically, to create an ESG, sustainability, or impact report, we need to know what we’re reporting, how, and why. We also need a team (or at least, a team lead) to oversee the reporting process. As mentioned earlier, from a legal and regulatory perspective, ESG reporting standards are varied, evolving, and often inconsistent from country to country and industry to industry. However, there are some general best practices your organization should follow when deciding what to report.

A good initial set of questions to start with is who are you (as a brand)? What is your mission or ESG theory of change? And what matters to your business and its various stakeholders?

Specifically, it’s often beneficial to conduct a "Materiality Assessment" early on in the process, a project which determines and ranks the most material themes for your business based on stakeholder interviews and surveys. For example, a healthcare company might focus on healthcare access, affordability, innovation, and its supply chain. A technology company could focus on data privacy, security, and STEM education access. A bank might designate financial inclusion as its most material theme. It will depend on your organization’s mission, makeup, goals, and ESG maturity.

Download a PDF copy of our Sustainbility Materiality Framework Template

During your materiality assessment, categorize and rank each theme or topic based on its importance to your business, its importance to stakeholders, and your ability to influence or impact it. The output can then be easily viewed and communicated as a Materiality Matrix, chart, or report.

Your materiality process should be led by a designated ESG or sustainability leader or manager working in close contact with company leadership and its stakeholder ecosystem. Internal ESG education and communication are critical components for building the baseline for a high-performance ESG culture, so make sure there’s top-down and bottom-up organizational alignment and stakeholder participation in these efforts. To ensure a fair, balanced assessment, we also recommend working with a trusted third party who can help administer and faciliate the materiality process.

At Brightest, we regularly help organizations with ESG materiality guidance, data services, and tools. If you’d like to learn more about our process and the different ways we can help, please get in touch.

ESG Investor Perspective

Investor perspective on ESG reporting and disclosure areas is also important. We always recommend engaging investors during your materiality assessment, even if you're a private company. If your company is publicly-listed, review your top institutional shareholders. What are their ESG portfolio criteria and methodology? Are there any dedicated ESG strategy funds? What ESG issues are they focused on?

Many larger institutional investors and fund managers like BlackRock, State Street, Fidelity, Vanguard and others post public information on their websites about their ESG criteria, voting approaches, and investment expectations. Be sure to review and familiarize yourself with that information.

Board Governance and ESG Reporting

In addition to the mechanics of ESG strategy and report creation, internal ESG efforts also need to account for - and garner support from - board and executive leadership. The percentage of boards with a sustainability, ESG, or CSR (corporate social responsibility) committees increased from 41% in 2018 to nearly 75% in 2022, according to research by Chief Executives for Corporate Purpose and the Society for Corporate Governance, a trend which has continued through 2022. Boards and the C-suite are increasingly taking ownership of the company's long-term climate strategy, risk, and opportunity profile, using the Task Force on Climate-related Financial Disclosures (TCFD) framework.

Operational ESG reporting, implementation, and execution within a company needs to happen across a company's management levels, but a company's ESG strategy will be most coherent and comprehensive when it's supported by governance structure and mindshare at the top.

ESG Reporting Strategy, Standards and Metrics

Once you’ve determined what matters to your business, the next step is to develop a strategy to address it, as well as figure out how to measure and report your work. Your ESG metrics and KPIs not only serve as your internal indicators and north star for progress and performance, but they’re also the foundation for your public-facing ESG reporting.

When it comes to deciding on your priority ESG metrics, there are at least four different approaches or inputs that can be used:

1. Reference Standards - In the absence of clear laws or regulatory requirements, third party standards bodies like GRI, SASB, and CDP provide recommendations, starter frameworks, and suggested metrics for reporting and disclosure.

2. Research and/or Talk to Peers - It's unlikely you're the first or only organization in your industry following this type of ESG reporting journey. Who are the ESG leaders in your sector? What are your peers reporting and measuring? Are there any established benchmarks? Desk research and peer conversations should be an important input into your process. Study, ask, and survey them.

3. Solicit Views from External ESG Analysts and Stakeholders - Similar to #2, your investors and other stakeholders may also have preferences or recommendations on your ESG metrics and disclosure focus.

4. Design Your Own - Ultimately, regulatory obligations aside, your ESG measurement, reporting, and disclosure process needs to feel right for your brand, business, and organizational context. We commonly see firm-specific ESG KPIs. Measuring what matters to your organization will lead to much better ESG outcomes than copying from others without context.

For reference examples, some notable third party ESG frameworks include:

GRI

Global Reporting Initiative (GRI) created the first global, third party sustainability and social impact measurement standards. The newest GRI Standards provide three sets (economic, environmental, and social) of 34 topic-specific standards to help companies report on material ESG issues to their investors and other stakeholders.

TCFD

The Task Force on Climate-related Financial Disclosures (TCFD) guides companies on disclosing climate-related financial risks to investors, lenders, insurers, and other stakeholders. TCFD is primarily a theme or pillar-based recommendations framework, one that is increasingly being used throughout the finance and banking sectors. In 2022, TCFD's received endorsement from the U.S. Securities and Exchange Commission (SEC), U.K. Financial Conduct Authority (FCA), the National Association of Insurance Commissioners (NAIC), and the Singapore Exchange (SGX).

CDP

CDP (formerly the Carbon Disclosure Project) manages a global environmental disclosure system used by more than 9,600 companies. Companies disclose by completing any or all of the three CDP questionnaires of climate change, forests, and water security.

SASB

The Sustainability Accounting Standards Board (SASB) develops and provides non-financial ESG reporting standards that track and communicate ESG performance areas and metrics that are most financially-material to your investors. SASB standards are industry-specific, and available for dozens of different sectors.

United Nations Sustainable Development Goals (SDGs)

The UN Sustainable Development Goals (SDGs) or Global Goals are a collection of 17 interlinked goals designed to serve as a "blueprint to achieve a better and more sustainable future for all." Many corporations and non-profits have used the SDGs to inform their ESG strategy, materiality understanding, reporting pillars, and disclosure themes.

B Corp

B Corp is a private certification and set of standards for corporate social and environmental performance. The B Corp framework is most widely adopted by smaller, privately-held companies.

While each framework is different, overlap among ESG frameworks is common. It's also routine practice for companies to consider or adopt multiple reporting frameworks. If you're new to reporting however, or this is your company's first ESG report, we recommend starting with one or two frameworks and focusing there. More complexity isn't always better when it comes to ESG measurement and reporting. For additional considerations on impact, ESG, and sustainability measurement frameworks, please also see our guides on Social Impact Measurement and Sustainability Measurement.

ESG Data Collection and Governance

ESG reporting doesn’t exist in a vacuum within your organization. Quite the opposite in fact. ESG is incredibly broad and holistic in scope, with considerations for nearly every department and area of your company's corporate strategy and operations.

When implementing ESG programs, it's important to make sure ESG and Sustainability leadership has strong executive support and buy-in. Moreover, in addition to a dedicated, internal ESG team, many organizations set up one or more ESG committees. These committees can be constructive at the executive or board-level to ensure support and resources for strategic ESG issues, targets, initiatives, announcements, and performance metrics. We also recommend a management or department-level ESG committee to serve as the conduit between the ESG team and internal departments who sponsor, support, and share data around specific ESG initiatives. This might include HR for employee engagement programs, CSR for social and community initiatives, or Product, Operations, and/or Facilities for environmental footprint-related information and accounting.

Many ESG frameworks provide ways to bridge these gaps between ESG areas like environmental sustainability and other departments like financial accounting, risk management, and compliance, but it's important to go beyond that. Educate employees and teams, create employee engagement opportunities tied to your ESG initiatives, and make ESG part of your organization's culture to truly elevate ESG and put it at the center of your brand and strategy.

Since many ESG and Sustainability teams run fairly lean, organizations often need external capacity help from consultants and technology partners. As you embark (or continue) along your ESG reporting journey, it can be helpful to ask questions like:

- What resources do you have to dedicate to ESG program and intitiative implementation?

- What resources do you have to dedicate to ESG data collection, management, and reporting?

- Do you have enough reporting team capacity during peak reporting season?

- What are the cases and opportunities to bring in outside help to make this process more efficient, transparent, and effective?

For example, Brightest's unified ESG reporting software provides tools for target-setting and tracking, project execution and evaluation, data collection and surveying, carbon accounting, and ESG report generation all in one system, sort of like a "Turbotax for ESG." Our tools and strategic support help organizations get report-ready faster, do more with less, and keep everything ESG-related in one central, secure place.

An ESG report scorecard and targets example from TD Bank. Source: TD Bank

How to Create an ESG Report - A Brightest Checklist

ESG reporting typically follows annual cycles that closely align to a company’s fiscal year-end and financial reporting cycle. For example, it’s common for a company whose fiscal year ends December 31st to start its ESG reporting work in September, October, or November, with the goal of completing and issuing the report in the spring of the following year, around IRS and financial reporting timelines.

From a content perspective, how you organize and present your report is up to you, but it's likely helpful to include sections that provide:

- An executive summary with highlights

- A description of your ESG process, methodology, and any frameworks used for guidance

- Your ESG targets, KPIs, and performance by pillar for environment, social, and goverance

- An ESG ratings and performance summary for investors (particularly if you are a publicly traded company)

- An overview summary of your financial performance and economic development value created

- An explanation of your company's mission and top ESG materiality themes

- A detailed, data-driven description of your ESG performance across each ESG pillar and materiality theme

- A carbon accounting and environmental footprint overview, with supporting data

- Any highlights, awards, press, or other relevant ESG-related third party recognition

- Your ESG risk management approach, highlighting key ESG risks and opportunities for your business

Stick to your materiality pillars and focus on what matters. It's better to do a few big, material, and impactful things well then spread yourself thin or report on lots of little incremental changes.

Need a system to orchestrate ESG reporting?

Brightest helps hundreds of companies around the world see, manage, measure, and report on ESG performance

When preparing your ESG, sustainability, or annual impact report, it's also helpful to consider several important questions:

- Who is the stakeholder audience of your disclosures? What stakeholder groups should be informed of your ESG work?

- What do you want your audience(s) to understand about your ESG efforts and performance? Again, what's most material?

- Should your report be structured around one or more ESG standards? If so, which one(s)?

- What are your data management and governance processes for collecting ESG data? Where does it live in your organization today? How are you accessing it? Make sure to map out all your data sources.

- Who is reviewing and approving the data going into your report? What is your review process to receive sign-off from corporate communications, finance, legal, compliance and other relevant internal departments? How will you track all that?

- Do we need external, third-party assurance of our report? Who will conduct the assurance review?

- What creative resources do you need (design, data visualization, editing, etc.)?

- Which corporate communication channels will be used for the release? Are there any dedicated website, press, social media, and/or internal communication campaigns to share the results?

- What are the relevant risks and regulatory considerations around your reporting disclosure?

- Where will your report methodology, inputs, and underlying data be archived?

- How do we improve and make better progress toward our targets next year?

Once you've answered and planned those questions, gather your data, review and verify it, create your report, then complete your internal stakeholder review and signoff process. Make sure to also work closely with Corporate Communications to craft your release plan and messaging, and engage legal to review your disclosures. Public ESG statements and should undergo the same review process as corporate financial reporting.

Remember that different groups will be interested in different aspects of your ESG efforts. For example, investors likely have different criteria and areas of interest compared to your employees. It’s critical to identify and understand these different interests to tailor your communication strategies to share relevant information and results for each group.

Putting It All Together

ESG and sustainability are both strategic considerations for companies and executive teams. This makes ESG or sustainability measurement and reporting an important communications cycle for modern organizations, particularly publicly-listed companies, ones operating in specific regulatory regions, or ones who need to meet specific supplier compliance obligations. While ESG reporting exellence can be complex and does require internal capacity, resources, and investment, it can also support a meaningful boost to your firm's brand, reputation, employee morale and retention, and risk management efforts. Increasingly, ESG and sustainability disclosure can even preserve — or open up new — customer relationships and de-risk revenue.

Disclaimer: ESG and environmental compliance, accounting, and disclosure standards and laws vary by country, state, and city - and are evolving quickly. This ESG reporting and disclosure guide is intended as a framework for planning and structuring your organization's ESG reporting strategy, sharing examples, best practices, and practical considerations around ESG and sustainability reporting. The information on this website does not, and is not intended to constitute or serve as legal or regulated financial accounting advice. Instead, all information, content, examples, and materials available on this site and within this toolkit are for general informational purposes only. Please consult with your corporate counsel or accountant to obtain advice with respect to any particular legal or accounting matter, respectively.