Materiality Assessment Essentials for ESG and Sustainability Strategy and Reporting

Materiality is a term that comes up often in sustainability and ESG (environmental social governance) strategy conversations. For corporate leaders and ESG practitioners, materiality is a powerful concept to understand and put into practice. Materiality assessments are projects to help an organization understand, organize, and prioritize its material topics and themes.

But before going any further, let's define what we mean when we talk about materiality.

What is Materiality?

Materiality comes from 'material'. Not material like a physical ingredient, but material meaning important to an organization. A material sustainability opportunity is something that can positively impact a company's business model, revenue, or profits. A material ESG or climate risk is a headwind that could negatively impact a corporation's operating or financial performance. Materiality is the principle of defining the social and environmental topics that matter most for your business, customers, investors, and other stakeholders

ESG materiality is rooted in financial accounting materiality. In finance, information is material if omitting, misstating, or obscuring it could reasonably be expected to influence decisions that users of financial statements make on the basis of those statements, which provide information about a specific reporting entity (like a company).

A common ESG materiality topic or theme is climate change. For example, if an insurance company insures property near the ocean, and climate change causes storms and rising sea levels that risk damaging those homes or buildings, that's a material financial risk for the business. Any potential investor will want to know that information if they're considering an investment in that insurance company.

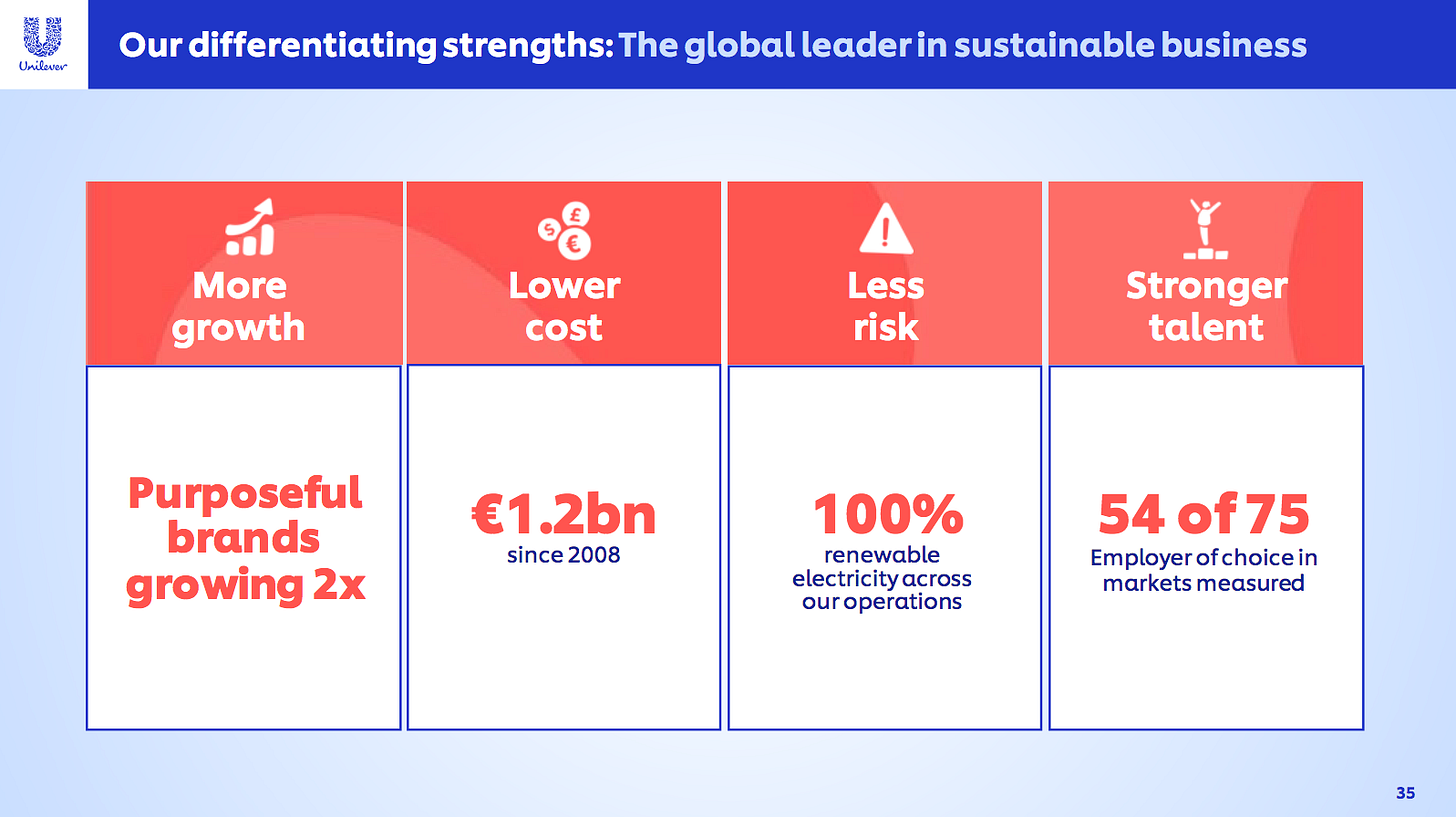

Similar risks and opportunities exist in farming, agriculture, and many other sectors. For example, global food company Unilever estimates it loses over €300 million a year due to worsening water scarcity and declining agricultural productivity caused by climate change. But on the flip side, adopting more sustainable sourcing practices has helped the brand realize over €1.2 billion in cost savings since 2008. Those data points indicate the materiality of climate change on Unilever's business, and demonstrates Unilever understands those themes, conducts materiality assessments, and uses those insights to inform its corporate strategy.

Why Are Materiality and Materiality Assessments Required in Sustainability and ESG?

~80% of Fortune 500 companies use materiality in their sustainability and ESG reporting, according to analysis by KPMG. Materiality is a growing strategy practice due to ESG investor requirements, proposed SEC climate disclosure rules, sustainability reporting standards like GRI, and European Union directives that require materiality in non-financial EU sustainability reporting.

Specifically, materiality and materiality assessments are required in sustainability reports according to:

- The European Sustainability Reporting Standards (ESRS) - EFRAG's sustainability reporting rules for the EU Corporate Sustainability Reporting Directive (CSRD) require double materiality analysis and reporting

- The International Sustainability Standards Board (ISSB) - A group and set of standards created by the International Financial Reporting Standards Foundation (IFRS) to serve as a global format for sustainability and climate reporting that meets the needs of CFOs and investors also requires double materiality

- GRI - One of the first global, third party sustainability and social impact measurement standards developed in 1997 and used by thousands of companies around the world, outlines materiality reporting requirements in "GRI: 3 - Material Topics"

Beyond disclosure requirements under specific standards, materiality is a corporate sustainability and ESG strategy and reporting best practice with many important benefits:

- It helps identify meaningful business opportunities, risks, trends, and brand attributes

- It makes it easier to decide which ESG themes and initiatives the company should prioritize

- It provides a clear framework for management decision-making and resource allocation

- It helps make sustainability and ESG strategy more structured and rigorous, by introducing a standard framework and methodology for evaluating and prioritizing materiality topics

- It can help improve collaboration between different departments and areas of the company, including corporate communications, investor relations, corporate social responsibility (CSR), sustainability, and people operations (HR)

- It clarifies what an organization needs to disclose in its ESG and sustainability reporting

- Any type of business (of any size or industry) can use and benefit from a materiality assessment

What's a Materiality Assessment Project and How Do You Determine ESG Materiality?

A materiality assessment is a project to identify, refine, and assess numerous potential environmental, social and governance (ESG) issues that might impact your business and/or your stakeholders, and organize them into a short list of topics to guide company strategy, targets, and reporting.

This could involve topics and themes that include, but are not limited to:

At Brightest, whenever we're working with a company or partner on materiality, we typically start with an industry and competitive landscape evaluation to understand what your peers are focusing on in ESG and sustainability. Next, we gather internal and external data and feedback to create a structured map of what ESG topics matter most for your organization. Finally, we synthesize and organize those topics and stakeholder response data into a materiality matrix, strategic plan, and set of recommendations that can be owned, adopted, and cultivated by your brand, executive leadership, and employees.

If you're using our sustainability and ESG software, our system can efficiently survey stakeholders and auto-generate a materiality matrix, which ranks and organizes your priority materiality topics. A materiality matrix typically measures three topic attributes:

- X-Axis - Importance (materiality) to your company

- Y-Axis - Importance (materiality) to your stakeholders (investors, partners, community, etc.)

- Bubble Size - Your company's capacity or ability to positively influence or work on the topic

For example, a healthcare company might determine through it's materiality assessment that disease preventation and treatment is an important topic within the overall materiality theme of 'access to healthcare.' From a materiality perpsective, we might rank disease preventation and treatment high on importance to the company and stakeholders, but low on our ability to influence it, because of the complexity of the global healthcare ecosystem and health policy.

Materiality assessment is the process of performing that analysis and synthesizing feedback and data from a company's leadership, employees, stakeholders, and operations to quantify material topics and themes.

How Materiality Impacts and Influences Sustainability and ESG Reporting

In ESG reporting, materiality helps organizations create and communicate more focused, structured, and meaningful sustainability reporting. By understanding which risks and information are most material to your business, investors, customers, employees, and other stakeholders, materiality strengthens your overall narrative since you know what topics are most important to talk about, and which can be safely omitted. ESG is very broad, so knowing what to priortize, track, and measure is essential to a successful implementation and reporting program.

Your Next Steps with ESG and Sustainability Materiality

Regardless of whether your organization has an established ESG or sustainability strategy and set of material topics, or you’re completing a materiality assessment for the first time, the process can be challenging or risk feeling vague. We recommend a structured, multi-phase process that helps set a clear plan, uses data-driven analysis and industry benchmarks to assess materiality relevance, and engages stakeholders throughout the organization to make sure we get to the right answers and test helpful hypotheses.

Done correctly, we believe companies who fully consider materiality create stronger, more resilient, and thoughtful businesses that are better prepared to inform investors, regulators, and other stakeholders on their ESG impacts, risks, and opportunities. If you have materiality needs or feel like your organization could benefit from materiality assessment help, please please be in touch.