How to Start an ESG Reporting Program - Last Updated: August 8, 2022

Today, most companies have committed to improving their environment, social, and governance (ESG) performance, reporting, and ratings to meet growing demands from investors, regulators, and customers. As a result, annual ESG reporting and implementation is an operating imperative for businesses of all sizes and sectors. But, if you're an organization that's newer to ESG and sustainability, where do you start? What are the right first steps in creating an ESG program?

For most organizations, we recommend following these general steps to start your ESG programs and reporting:

- Understand your ESG "why" or purpose

- Conduct an ESG readiness and resources assessment

- Complete a materiality assessment

- Outline an ESG strategic roadmap

- Set your initial ESG goals and targets

- Formalize ESG governance and policies

- Determine budgets, headcount, and other resources

- Develop internal guides, toolkits, processes, and policies

- Educate and engage key ESG stakeholders

- Establish ESG data systems and processes

- Design and complete your first ESG report

- Track ESG progress, revise targets, and take action on key learnings, risks, and opportunities

This playbook will guide you through each of these key steps in ESG strategy development and program implementation.

First, let's define a few key concepts and terms.

What is ESG Reporting? A Quick Definition

An ESG report is a disclosure communication designed to increase corporate transparency about an organization’s ESG performance, risks, and opportunities. ESG reports should be clear, data-driven (rather than vague, anecdotal, or solely qualitative), honest (not “greenwashing"), and tell a clear story about how your company is pursuing better social, environmental, and equitable outcomes for its employees, customers, external communities, and the planet, backed by evidence.

ESG reports are typically published by the ESG, investor relations, or corporate affairs department of a company, and creating ESG reports is a collaborative, cross-departmental effort.

Why is ESG Reporting So Important for Companies?

In most countries, ESG reports are voluntary, not mandatory. However, recent 2022 legal changes, announcements, and impending mandates in the United States, Canada, European Union (EU), United Kingdom, Singapore, Australia, and other regions are creating stricter disclosure obligations for many types or organizations - particularly publicly-listed companies - to measure and report their ESG performance. For example, in the EU, between 2024 and 2028 most companies with European operations will need to publicly disclose ESG and sustainability indicators to comply with the EU Corporate Sustainability Reporting Directive (CSRD)

Moreover, many investors and large companies - including Walmart, Disney, and Amazon - are increasingly asking their investments, vendors, suppliers, and partners to complete ESG and sustainability commitments, questionnaires, and disclosures. Employees, customers, and communities are also likely to advocate for larger and more impactful ESG commitments from brands.

Why Do You Want to Start an ESG Reporting or Implementation Program?

Before we get into how to start an ESG reporting and implementation programs, let's talk a little bit about why we're doing this. What's your company's core motivation or purpose for pursuing ESG? What's the business case? That should always be step one.

Generally, in our experience working with over 100+ companies at various stages of their ESG journey, there are usually five primary why's tied to key stakeholder needs:

- Investors - Investors, asset managers, and other capital providers want to understand a company's ESG rating, performance, and risk profile

- Customers - People and companies want to buy from transparent, accountable organizations that value the environment and society

- Regulators - Companies need to comply with future regulatory-based ESG reporting requirements, like the draft SEC climate disclosure proposal in the U.S. or the German DNK (Sustainability Code) under CSR-RUG and the EU Corporate Sustainability Reporting Directive (CSRD)

- Employees - Employees, particularly younger generations, want to work at companies that are committed to ESG principles and issues like climate action, diversity, equity, health, wellness, and safety

- Sustainable Competitive Advantage - Sustainability sells, and innovative, sustainable products and services are increasingly well-positioned to outcompete peers in the market

Your ESG "why" should in turn inform your top focus areas and prioritization. If your primary "why" is investors or regulators, focus on reporting and disclosure. If it's employees and workers, prioritize social programs, training, learning, and development. If it's sustainable competitive advantage, orient resources towards R&D, product development, sustainable supply chain engagement, and decarbonization.

Don't commit resources or start developing an ESG strategy until you're clear on why.

Conduct an ESG Readiness and Resources Assessment

An internal capabilities assessment is also an important prerequisite for diving into ESG or sustainability. Does the company's board and senior leadership have ESG expertise? Is there an experienced ESG or sustainability lead to champion, manage, and steer internal efforts? Are other teams like HR, product, facilities, operations, and supply chain educated and bought in?

Building an ESG program that isn’t properly supported or resourced can be as much of a reputation risk as inaction. Investors, customers, and other stakeholders can easily identify low levels of ESG commitment and progress. If your ESG efforts aren't championed by an executive like the CEO, CFO, or Chief Sustainability Officer, and aren't actively managed by a capable, department-level leader, your organization needs to address ESG leadership attention and resourcing before progressing further.

Another important ESG self-assessment question is ambition. Do you have the type of brand, culture, and org structure where ESG principles and practices can catch on quickly? Or will ESG implementation require long-term education, integration, buy-in, and cultivation? Is your company willing to invest in what it takes to be a leader? Or is it more important to stay competitive and keep up with peers, trends, and benchmarks? Does ESG require a re-org?

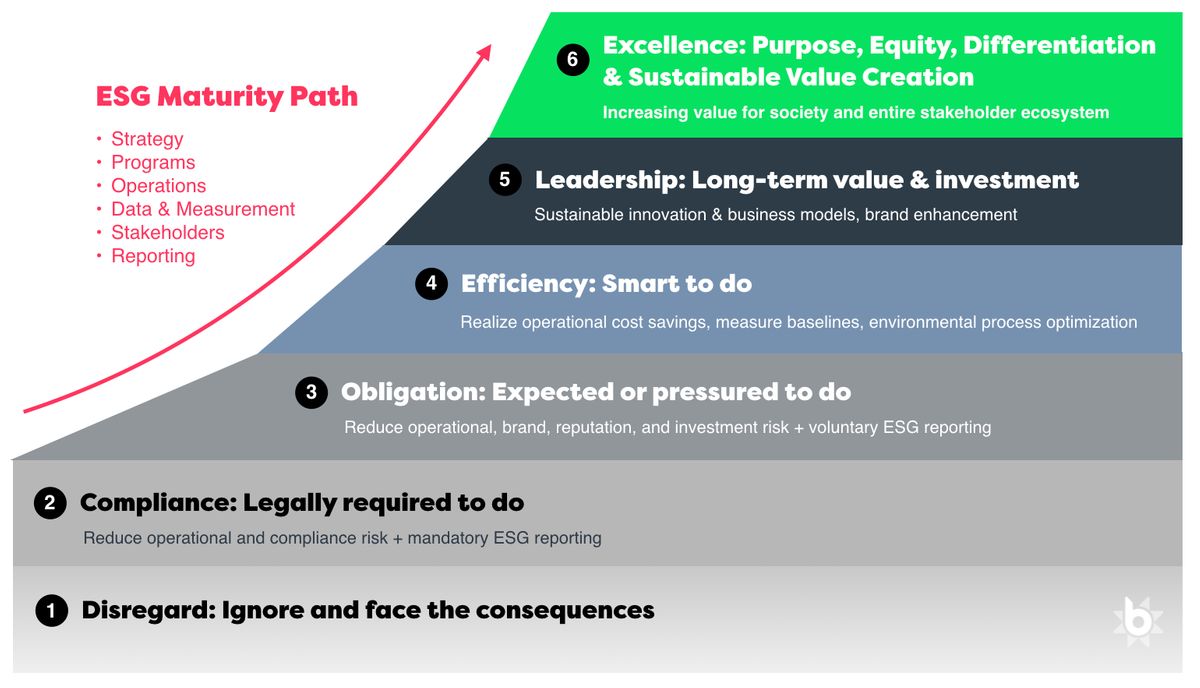

Most organizations advance along an ESG readiness and maturity curve, moving from mandatory ESG compliance toward ESG excellence and sustainable innovation as a true differentiator.

Taking stock of your internal readiness will help identify important resource, culture, and capability gaps, so you can proactively address them to pave the way for the next series of ESG integration steps.

Complete an ESG Materiality Assessment

Your ESG approach should reflect your brand, business model, company size, industry, and value chain. For example, if you’re a manufacturing company, energy usage and greenhouse gas (GHG) emissions from sites and facilities should be a material sustainability priority within your overall ESG strategy. By comparison, an apparel company might focus on sustainable sourcing and procurement, social compliance, water stewardship, and Scope 3 emissions from its supply chain, because those are most material to its sector. Most companies should consider employee, management, and board-level diversity as a material social set of ESG metrics.

A materiality assessment is a project to identify, refine, and assess numerous potential environmental, social and governance issues that could affect your business, and/or your stakeholders, and organize them into a short list of prioritizable topics that inform company strategy, targets, and reporting. Materiality is a powerful ESG tool because, when done properly, it creates both consensus and focus around ESG efforts.

A thoughtful, thorough materiality assessment process can be a helpful initial step in designing ESG KPIs (all of which can be encoded into Brightest's ESG reporting software for easy data collection, performance tracking, and stakeholder communication)

Look at your company's business model, brand, and purpose: ESG should build off that foundation and be a vehicle for positive organizational, environmental, and social change and performance improvement. Your materiality market screen should analyze industry benchmarks, peers, and ESG standards, which will help provide an initial universe of KPIs to select from.

For more on ESG materiality, please read our guide here. Or feel free to contact us directly for materiality help or questions.

Outline a Strategic ESG Roadmap

Your ESG programs and implementation should be guided by an overarching strategic plan that clearly outlines your ESG priorities, goals, approach, and integration timeline. Developing a roadmap will further solidify internal consensus and visibility around your firm's ESG direction to ensure accountability and adequate resource allocation. Revisit the level of ESG and sustainability ambition you previously identified, and outline what it will take to deliver on those commitments.

Need a system to orchestrate ESG reporting and internal programs?

Brightest helps hundreds of companies around the world see, manage, measure, and report on ESG performance

Set Your Initial ESG Targets and Goals

Now that you understand your ESG purpose, readiness, and top, material priorities, you're ready to start formulating a strategy and setting concrete targets and goals. Work with different senior leadership and different stakeholders across your organization - finance, operations, supply chain, HR - to design a focused set of targets and KPIs to track ESG progress and performance. These targets and indicators should be based on ESG or sustainability reporting standards, ratings methodologies, peer benchmarks, and operational feasability studies. For example, a leading global beauty brand tracks 40 top ESG KPIs across its business, with different department leads responsible for specific metrics. A smaller company or startup will likely want a narrower focus.

In many ESG areas, there are already established, industry standard KPIs and targets. In environmental sustainability, measuring greenhouse gas emissions (GHG) in Scope 1, 2 & 3 emissions of carbon equivalents (CO2e) generated is an established, material indicator. Emissions reduction targets can be set using the science-based targets methodology.

On the social side, EHS (Environmental Health and Safety), HR, CSR, and employee demographic data also have established KPIs. Common examples include:

- Management diversity

- Overall employee diversity

- Average hourly wage

- Minimum and livable wage comparisons

- Employee turnover rate

- Employee training and L&D rates

- Workplace injury occurence rate by type, severity, cost, and remediation

- External community benefit and economic development indicators

Common ESG governance KPIs and targets should be set around issues and topics like:

- Board diversity

- Board ESG experience and subject-matter expertise

- Management training in ethics, anticorruption, and other key ESG areas

- Executive compensation (ideally tied to ESG performance)

- ESG-related compliance incidents, penalties, and remediation

- ESG-related litigation incidents and remediation

- Cybersecurity incidents, risk management, and remediation

Be sure select metrics and targets that are material and relevant. For example, employee volunteering participation could be a helpful indicator for employee engagement, but likely not for community impact or overall ESG performance, as there are often better ways your organization can help vulnerable communities or report impact. The more your ESG initiatives and communication efforts focus on material change and credible KPIs, the stronger your ESG reputation will be.

Similarly, rather than trying to boil the ocean or appease everyone, focus on setting (and measuring) a few priority targets, then build from there.

Formalize ESG Governance, Policies, and Decision-Making Structure

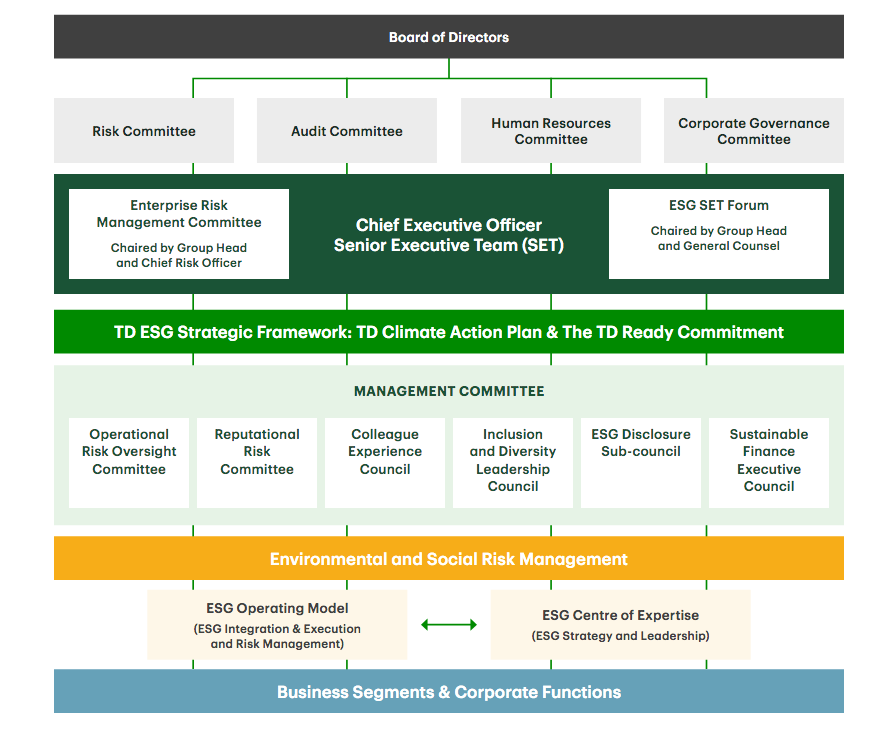

Long-term ESG success and investment requires governance, structure, and accountability. The optimal structure for governing your ESG efforts will depend upon the organization, but ESG needs to have active visibility, accountability, and mindshare within the C-suite and at the board level.

We've seen ESG efforts succeed where ESG is owned at the executive level by the CFO, a Chief Sustainability Officer, a head of ESG, or sometimes another C-suite leader like the Chief Communications Officer. Whoever owns ESG, it needs to be a core job responsibility, and that leader needs to be senior enough to marshall resources, promote the necessary internal collaboration, provide oversight, and move critical initiatives forward.

An example ESG governance structure from TD Bank. Source: TD Bank

Another critical ESG implementation step is developing smart, comprehensive ESG policies and guidelines. From your firm's code of ethics and conduct to labor, health, safety, procurement, and environmental practices, its important to design ESG into your organization's day-to-day operating guidelines.

As your company moves forward with ESG implementation, make sure to also establish clear decision-making and approval structures, accountability, visibility, and oversight. This should take the form of multiple committees or working groups at different levels of your organizaton:

- Board-level ESG committee - An ESG, sustainability, audit committee, or other board group tasked with board-level ESG oversight (it may also make sense to matrix out specific ESG topics to different board committees (such as risk or HR)

- Executive leadership ESG committee - A cross-functional group of senior executives and leaders who can steer and guide strategic ESG collaboration, programs, and resource allocation

- Operational ESG committee or "green team" - A cross-departmental network of managers who are implementing ESG programs, collecting ESG data, supporting ESG reporting, or interfacing and collaborating with ESG and sustainability department members

To succeed in an organization, ESG needs both oversight structure, and operational integration.

Determine Budgets, Headcount, and other Resources

Once you've established your ESG approach and structure, you need to empower ESG action. Again, resource allocation should follow organizational priorities. If the goal is operational decarbonization, budgets should support programs like renewable energy purchasing and energy efficiency retrofits. If your top priority is investor and regulatory disclosure, include sufficient budget for ESG reporting headcount, technology, data, and capacity.

A common (and unfortunate) theme we often see in ESG and sustainability is under-resourcing. The board and senior management commit to an ESG strategy, hire one ESG or sustainability manager to lead the effort, assign them an intern, and call it a day. This rarely leads to the level of ESG integration, progress, and performance companies hope for.

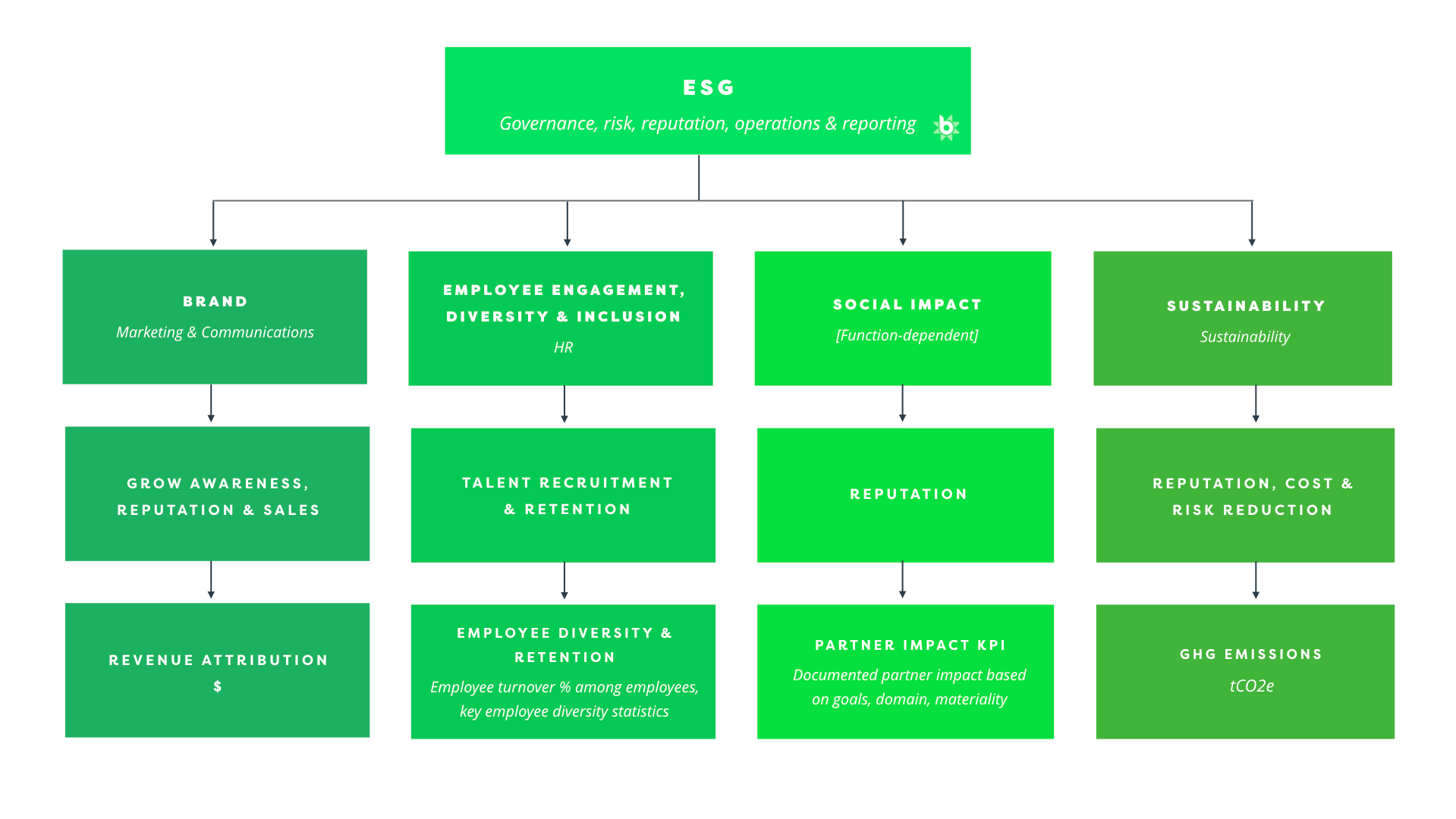

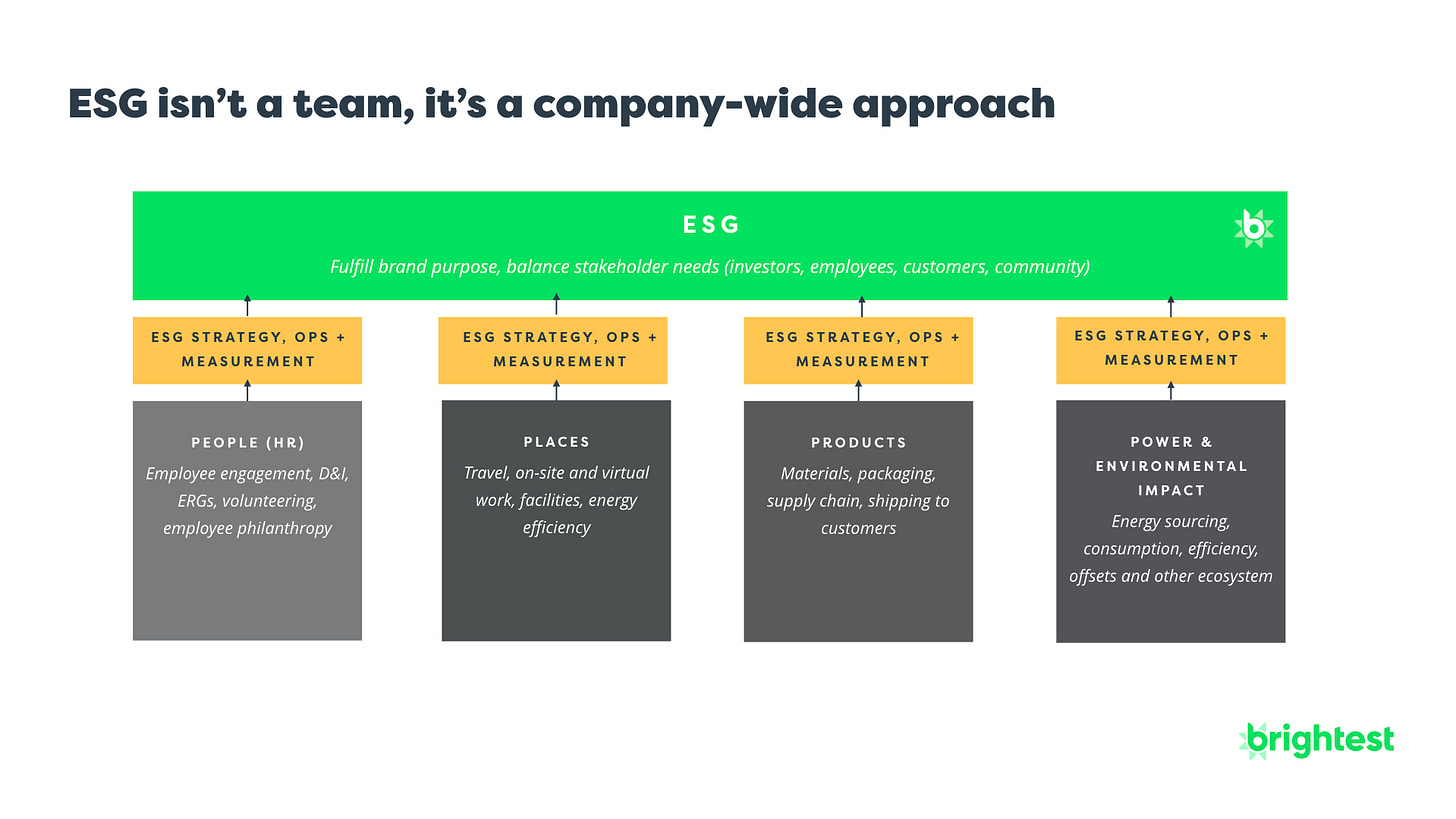

ESG isn't a job title, it's a company-wide approach that needs to be developed and cultivated around a strong business or ROI case.

At a mimimum, where possible, we recommend designing a budget that supports:

- Senior ESG or sustainability leader - A VP or director-level hire who can provide department oversight, recruit, mentor, and develop talent, and help translate strategic ESG goals into actionable roadmaps and implementation plans

- ESG reporting manager - The manager responsible for project managing and producing annual ESG reports and disclosures, as well as responding to inbound questionnaires and information requests

- ESG analyst or associate - A team-member who can focus on ESG data collection, benchmarking, industry analysis, and other areas related to supporting ESG report creation

- Program budget - For specific ESG projects, initiatives, and any ESG or sustainability-related capital improvements

- ESG reporting technology and tools - A collaborative, audit-ready system for managing ESG data, reports, and supporting materials, as well as any other data feeds, subscriptions, and tools needed for informed ESG decision-making

ESG should be seen as a strategic set of business practices - and a major hedge against downside risk. Establish a strong business case for ESG and make sure your organization doesn't under-invest.

Develop internal guides, toolkits, processes, and policies

Policies, guides, toolkits, and other governance mechanisms help communicate and reinforce ESG operating structures you establish. They also help to scale ESG knowledge, awareness, and sound decision-making around the organization.

Establish rules, trainings, guidelines, and resources around areas like:

- Enviromental stewardship and climate action policy

- Responsible sourcing guidelines

- Anti-harassment and discrimination

- Diversity, equity, inclusion, and belonging

- ESG employee education

- Employee travel

- Business ethics and code of conduct

- Cybersecurity

And other important ESG themes. In each of these areas, it's important to understand whether or not a project, process, or policy already exists internally, and, if it does, has it been recently reviewed to be consistent with the firms ESG positions and strategy? If a policy isn’t public, should it be?

Educate and Engage Key ESG Stakeholders

Successful ESG integration requires significant internal and external stakeholder collaboration. Don't overlook this step. Make sure ESG is visible across the organization.

To accomplish this consider different communications channels like road shows, internal meetings, company newsletters, employee training, corporate website, social media, and other spaces and channels where ESG issues and activities. Employees working in ESG will understand why we're doing this and why it matters, but does everyone else? Do they know the best way to be supportive and contribute to the firm's ESG goals?

Investor perspective on ESG priorities and disclosure areas is also important. We always recommend engaging investors during your materiality assessment, even if you're a private company. If your company is publicly-listed, review your top institutional shareholders. What are their ESG portfolio criteria and methodology? Are there any dedicated ESG strategy funds? What ESG issues are they focused on?

Many larger institutional investors and fund managers like BlackRock, State Street, Fidelity, Vanguard and others post public information on their websites about their ESG criteria, voting approaches, and investment expectations. Be sure to review and familiarize yourself with that information.

Establish ESG Data Systems, Dashboards, and Processes

Credible ESG programs are based on reportable, repeatable, auditable, and high-quality data. Start by creating a data inventory that includes:

- What data needs to be collected, both for internal KPI tracking and reporting

- Where it exists now (system, spreadsheet, etc.)

- Who's responsible for it (department, individual, etc.)

- Any quality or accessibility issues.

- Relevant industry benchmarks

Most organizations don't focus enough on developing ESG data quality and collection workflows. Think about what's most needed in your organization, who you need to collaborate with, look for opportunities to improve, and engage your ESG reporting partners and stakeholders on best practices and ways they can support this.

Brightest automates ESG data collection from different departments, sources, and systems, including integrations, spreadsheets, and surveys

ESG reporting can be a complex process, particularly for larger enterprise businesses or organizations. For a lot of the same reasons why it's better to use dedicated accounting software like Quickbooks or Oracle Netsuite to produce corporate financial reports like a 10-K, manual and spreadsheet-based ESG reporting and data management is error-prone, inefficient, and has major visibility, collaboration, accuracy, and governance issues. It also just takes a lot more time.

Given that ESG disclosure requirements are being written into everything from SEC regulation to procurement contracts in 2022, this is information that needs to be accurate, consistent, structured, and easy to access - and shouldn't tie up all your time to collect and communicate.

Moreover, ESG reporting is a recurring annual obligation. It's much more efficient to use a system that's purpose-built for auditing, archiving, historical comparison, and benchmarking. Getting the right tools and systems in place early is immensely helpful for tracking performance, comparing past reports, or implementing data best practices.

Design and Complete Your First ESG Report

Once you've assessed stakeholder reporting needs, designed KPIs, and and developed a system or framework for collecting and verifying ESG data, you can now start focusing on what specifically to disclose in your first ESG report.

Make sure to consider:

- What's our brand's ESG narrative and story?

- What if any ESG metrics, disclosure, and communications have we reported before?

- Is our disclosure information material? Does it help stakeholders make informed decisions about our business?

- What are the benefits of disclosing this information?

- Are there any reputational or legal risks to disclosing this information

- Do we need any external help preparing this report?

ESG reporting typically follows annual cycles that closely align to a company’s fiscal year-end and financial reporting cycle. For example, it’s common for a company whose fiscal year ends December 31st to start its ESG reporting work in September, October, or November, with the goal of completing and issuing the report in the spring of the following year, around IRS and financial reporting timelines.

From a content perspective, how you organize and present your report is up to you, but it's likely helpful to include sections that provide:

- An executive summary with highlights

- A description of your ESG process, methodology, and any frameworks used for guidance

- Your ESG targets, KPIs, and performance by pillar for environment, social, and goverance

- An ESG ratings and performance summary for investors (particularly if you are a publicly traded company)

- An overview summary of your financial performance and economic development value created

- An explanation of your company's mission and top ESG materiality themes

- A detailed, data-driven description of your ESG performance across each ESG pillar and materiality theme

- A carbon accounting and environmental footprint overview, with supporting data

- Any highlights, awards, press, or other relevant ESG-related third party recognition

- Your ESG risk management approach, highlighting key ESG risks and opportunities for your business

Stick to your materiality pillars and focus on what matters. It's better to do a few big, material, and impactful things well then spread yourself thin or report on lots of little incremental changes.

When preparing your ESG, sustainability, or annual impact report, it's also helpful to consider several important questions:

- Who is the stakeholder audience of your disclosures? What stakeholder groups should be informed of your ESG work?

- What do you want your audience(s) to understand about your ESG efforts and performance? Again, what's most material?

- Should your report be structured around one or more ESG standards? If so, which one(s)?

- Who's reviewing and approving the data going into your report? What is your review process to receive sign-off from corporate communications, finance, legal, compliance and other relevant internal departments? Do you need audit or assurance? How will you track all that?

- What creative resources do you need (design, data visualization, editing, etc.)?

- Which corporate communication channels will be used for the release? Are there any dedicated website, press, social media, and/or internal communication campaigns to share the results?

- What are the relevant risks and regulatory considerations around your reporting disclosure?

- Where will your report methodology, inputs, and underlying data be archived?

- How do we improve and make better progress toward our targets next year?

Once you've answered and planned those questions, gather your data, review and verify it, create your report, then complete your internal stakeholder review and signoff process. Make sure to also work closely with Corporate Communications and/or Investor Relations to craft your release plan and messaging, and engage legal to review your disclosures. Public ESG statements and should undergo the same review process as corporate financial reporting.

Remember, different stakeholders will be interested in different aspects of your ESG efforts. For example, investors likely have different criteria and areas of interest compared to your employees. It’s critical to identify and understand these different interests to tailor your communication strategies to share relevant information and results for each group.

Track ESG Progress, Revise Targets, and Take Action on Key Learnings, Risks, and Opportunities

Each company is unique, and ESG reporting and implementation is an ongoing journey and learning process. While there's no one-size-fits-all approach to ESG program design and reporting, approaching it as a long-term, continuous improvement practice is immensely beneficial. Above all, ESG is certainly not a short-term trend. Issues like climate change, public health, social well-being, and diversity will remain top-of-mind for regulators, consumers, and business decision-makers for years.

While ESG reporting may feel like a burden or obligation, dozens of data and examples show strong, thoughtful, and strategic ESG programs and performance is a competitive business advantage that delivers positive ROI. Many companies start ESG work due to compliance and investor pressures, only to find that as their ESG investments, maturity, and capabilities evolve, their company realizes significant cross-company benefits and efficiencies.

Every company's ESG roadmap is different - and ESG truly is a long-term, strategic journey for boards and management teams. Nonetheless, the benefits of strong ESG performance on brand reputation, employee talent, culture, operational efficiency, risk management, and access to capital are not only numerous - many are quantifiable.

Above all, we wish you all the best as you continue ahead with your ESG reporting program and roadmap. If we can be helpful at all (at any step in your ESG journey), please get in touch. A central part of our mission and work here at Brightest is enabling better data-driven decision-making (and actions) to help companies achieve their full ESG potential.