Brightest's Sustainability Reporting Guide 2022

What is Sustainability Reporting? A Definition:

A sustainability report summarizes and communicates an organization's sustainability and environmental social governance (ESG) performance. Sustainability reports typically share a company's top sustainability KPIs and achievements, as well as its progress toward sustainabilty goals and targets. Most companies issue an annual sustainability report once a year

Governments, companies, and NGOs use sustainability reporting (and reports) to communicate their performance on a wide range of sustainability topics, including their environmental footprint, greenhouse gas (GHG) emissions, materials and resource use, and supply chain sustainability. Sustainability reports are the primary tool organizations use to publicly communicate their environmental risks, opportunities, and practices to stakeholder groups like investors, government regulators, partners, employees, and customers. Sustainability reporting is an environmental-focused sub-category of ESG (environmental social governance) reporting.

For anyone working in sustainability, ESG, and, increasingly, corporate finance, sustainability disclosure has become the fastest-growing type of non-financial reporting over the last ten years. 90% of the largest 500 companies by market cap published a sustainability report in 2019. And many more companies continue to adopt and issue sustainability reporting in 2022.

Voluntary GRI Sustainability Reporting Growth (1999-2021)

Last Updated: 2021

Source: GRI (Global Reporting Initiative)

However, unlike traditional financial accounting, sustainability reporting and carbon accounting don't (yet) use the same transparency and consistency. Today there are over 600 different sustainability reporting standards, industry initiatives, frameworks, and guidelines around the world, which can make sustainability reporting a complex, research-heavy, and repetitive process.

In most countries, sustainability reports are voluntary, not mandatory. However, recent 2021-2022 legal changes, announcements, and impending mandates in the European Union (EU), United Kingdom, Singapore, and other regions are creating stricter disclosure obligations for many types or organizations -- particularly publicly-listed companies -- to measure, report, and disclose their sustainability and ESG performance. As a result, most companies select which standards to use for reporting - and how, to some extent, they report performance based on guidance from regulators, investors, and ratings organizations.

Sustainability reports are typically (1) published on a company's website, (2) announced in a press release and other corporate communications, and (3) disclosed to standards entities and analysts, who may grade or list the report on their website or disclosure portal.

For example, if your company submits a sustainability report to CDP (formely Carbon Disclosure Project), CDP will publish your score. Sustainability and ESG reports may also be shared or disclosed to other key stakeholders, like investors or partners.

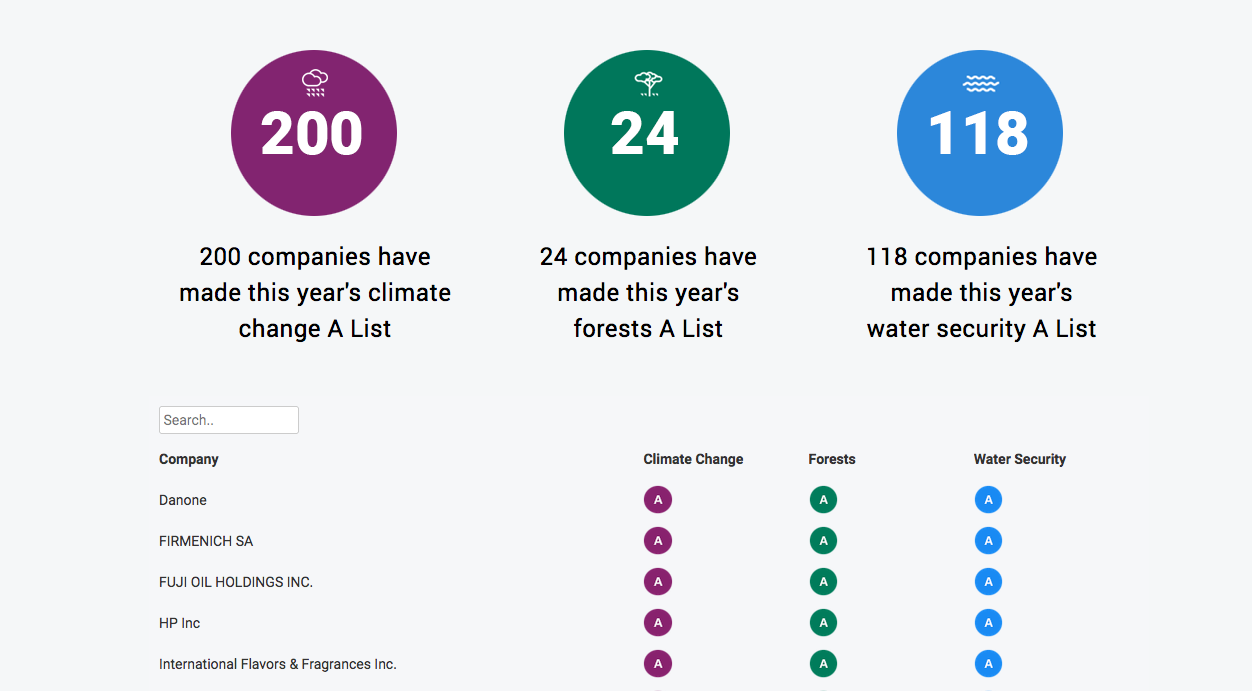

Public sustainability report scorecard example from CDP. Source: CDP

The push for sustainability reporting standardization is finally under way among many governments and standards orgs like CDP, CDSB, GRI, IIRC, SASB, and the IFRS Foundation (see our standards guide here), which hopefully moves the industry closer to universal sustainability reporting standards.

How to Get Started With Sustainability Reporting

Logically, in order to create a sustainability report, we need to know what we’re reporting. We also need a team (or at least, a team lead) to oversee the reporting process. As mentioned earlier, from a legal and regulatory perspective, sustainability reporting standards are varied, evolving, and often inconsistent from country to country and industry to industry. However, there are some general best practices your organization should follow when deciding what to report, how, and why.

A good initial set of questions to start with is who are you (as a brand or business)? What's your mission? What matters most to your various stakeholders (investors, employees, customers, partners)?

Specifically, it’s often beneficial to conduct a “Materiality Assessment” early on in the process. A materiality project determines and ranks the most material sustainability themes and topics for your business, using stakeholder interviews and survey data. For example, a healthcare company might focus on healthcare access, affordability, innovation, and its supply chain. A technology company could focus on data privacy, security, and STEM education access. A bank might designate financial inclusion as its most material theme. It will depend on your organization’s mission, makeup, goals, and ESG maturity.

Download a PDF copy of our Sustainbility Materiality Framework Template

During your materiality assessment, categorize and rank each theme or topic based on its importance to your business, its importance to stakeholders, and your ability to influence or impact it. The output can then be easily viewed and communicated as a Materiality Matrix, chart, or report.

Your materiality process should be led by an experienced sustainability leader or manager working in close contact with company leadership and its stakeholder ecosystem. Internal sustainability education and communication are critical components for building a cultural baseline, so make sure there’s top-down and bottom-up organizational alignment and stakeholder participation in these efforts. To ensure a fair, balanced assessment, we also recommend working with a trusted third party who can help administer and faciliate the materiality process.

At Brightest, we regularly help organizations with sustainability reporting guidance, data services, and tools. If you’d like to learn more about our process and the different ways we can help, please get in touch.

Selecting Sustainability Reporting Targets, Standards and KPIs

For organizations, selecting which sustainability targets, standards, frameworks, and metrics to define your reporting strategy is an important early step on the path to measuring, communicating, and improving your environmental performance. It's better to focus on doing a few things well instead of trying to do everything.

We recommend starting with a few established, priority sustainability standards, metrics, and goals. Similarly, make sure your targets and KPIs are science-based, data-backed, and realistic.

For example, let's say your corporate sustainability north star is achieving carbon neutral or net zero operations by 2028. In other words, you'll reduce, eliminate and/or offset our company's entire carbon footprint. In order to know if that's a realistic target, we need to know what your company's total emissions are today through carbon accounting, benchmarking, and sustainability measurement and data collection projects.

If you haven't already accounted for all your company's carbon and greenhouse gas (GHG) emissions, setting a carbon target probably isn't a realistic or advisable goal. Start by accounting for all your emissions before you take any further steps toward sustainability reporting.

The #1 Sustainability Reporting KPI: Scope 1, 2 & 3 Emissions

The most widely-recognized, material sustainability reporting KPI set is your company's Scope 1, 2 & 3 greenhouse gas (GHG) emissions. For more on carbon accounting emissions, please read our introductory guide here

Similarly, if you have counted your carbon but don't have an operationally credible path to get there within your forecasting horizon, you also may want to revise your emissions targets. This process of coming up with data-driven, science-based targets is critically important.

Once you've set and validated your science-based targets (i.e., "Carbon neutral by 2028"), define your KPIs and key metrics. For example, for emissions reduction, we'd likely use a quantifiable, trackable metric tons of carbon equivalents (tCO2e). Using established, independent sustainabilty standards and working with trusted third parties can help your organization identify other common sustainability KPIs, establish priorities, measure performance and progress, anticipate risks, and managing change.

Peer-to-Peer Value Chain Sustainability Reporting

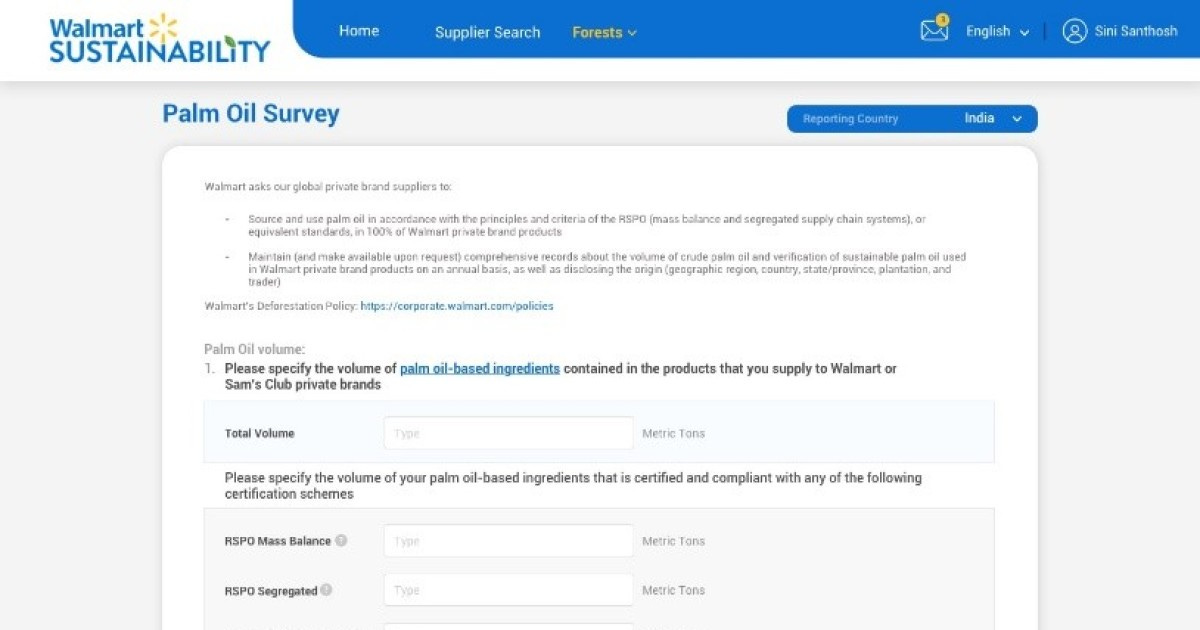

Increasingly, many companies, including Amazon, Walmart, Disney, and Salesforce now survey their vendors for sustainability information about their business. If a company like Walmart or Amazon considers a specific metric relevant to your business, and you consider your business with them to be important, it's a good idea to start measuring it so you can report it to them.

Sustainability reporting example from Walmart. Source: Walmart

No matter what, be sure to use sustainability standards and metrics that are (1) widely used, (2) fit your business, and (3) help constructively guide good priorities, actions, investments, and decision-making.

Top Sustainability Reporting Standards in 2022

For organizations that are new to sustainability reporting - or looking to broaden their sustainability disclosures - we recommend researching and orienting your sustainability reporting around one or more of the following sustainability reporting standards. Each one is globally recognized, widely adopted, thoughtfully-designed, and appears likely to evolve in future versions in a direction consistent with universal reporting standards convergence and international regulatory changes.

EU CSRD

Type: Sustainability

Themes: Sustainability and Environmental Reporting

Number of participants: 50,000+

Required for: EU companies with 500+ employees and/or that are publicly traded

Stakeholder audience: Regulators and other EU stakeholders

The EU Corporate Sustainability Reporting Directive (CSRD) is an update to the Non-Financial Reporting Directive (NFRD) which takes effect in 2023 and broadens mandatory EU sustainability reporting standards for most companies. The goal of CSRD is to make corporate sustainability reporting more common, standards-based, and closer to financial accounting and reporting.

TCFD

Type: Sustainability

Themes: ESG & Climate Financial Risk

Number of participants: ~2,600+ supporting organizations

Best for: Large Companies

Stakeholder audience: Investors

The Task Force on Climate-related Financial Disclosures (TCFD) guides companies on disclosing climate-related financial risks to investors, lenders, insurers, and other stakeholders. TCFD is primarily a theme or pillar-based recommendations framework, one that is increasingly being used throughout the finance and banking sectors, and championed by the US Securities and Exchange Commission (SEC), UK Financial Conduct Authority (FCA), the National Association of Insurance Commissioners (NAIC), and the Singapore Exchange (SGX).

ISSB (IFRS)

Type: Sustainability

Themes: General Sustainability Accounting, Risks & Opportunities

Number of participants: TBD

Best for: Medium-to-Large Companies

Stakeholder audience: Investors, CFOs and Finance

The IFRS Sustainability Disclosure Standards were created in 2022 by the International Sustainability Standards Board (ISSB) to serve as a global format for sustainability and climate reporting that meets the needs of CFOs and investors. While newer, and still in development, given the IFRS's influence role in financial reporting, these standards should help connect sustainability reporting information with a company's financial statements and accounting.

CDP

Type: Sustainability

Themes: Climate, Supply Chain, Forest, Water

Number of participants: 9,600

Best for: Medium-to-Large Companies

Stakeholder audience: Investors, Supply Chain

CDP (formerly the Carbon Disclosure Project) manages a global environmental disclosure system used by more than 9,600 companies. Companies disclose by completing any or all of the three CDP questionnaires of climate change, forests, and water security. CDP also includes an optional 4th supply chain reporting module. CDP publishes the scores of reporting companies on its website.

GRI

Type: Sustainability

Themes: General

Number of participants: ~10,000

Best for: Any Type of Organization

Stakeholder audience: All

Global Reporting Initiative (GRI) created the first global, third party sustainability and social impact measurement standards in 1997. The newest GRI Standards provide three sets (economic, environmental, and social) of 34 topic-specific standards to help companies report on material ESG issues to their investors and other stakeholders. GRI has no central oversight function – but companies can choose to make their reports available via a database on the GRI website.

SASB (Value Reporting Foundation)

Type: Sustainability

Themes: ESG Financial Risk

Number of participants: ~800

Best for: Large Companies

Stakeholder audience: Investors

The Sustainability Accounting Standards Board (SASB) develops and provides non-financial ESG reporting standards that track and communicate ESG performance areas and metrics that are most financially-material to your investors. SASB standards are industry-specific, and available for dozens of different sectors. In 2021 SASB merged with the IIRC (International Integrated Reporting Council) to create the Value Reporting Foundation with the goal of providing an integrated reporting framework to connect sustainability reporting with financial disclosure.

B Corp

Type: Sustainability

Themes: ESG & Climate Financial Risk

Number of participants: >4,000

Best for: Small-to-Medium Companies

Stakeholder audience: All

B Corp is a private certification and set of standards for corporate social and environmental performance. The B Corp framework is most widely adopted by smaller, privately-held companies.

Each of these standards is unique, but generally covers a comprehensive set of sustainability topics and reporting themes. Some like TCFD don't require companies to disclosure specific metrics and KPIs in a dictated format, whereas other frameworks like CDP and B-Corp provide much more detailed, complex, and specific information sharing.

In September 2020, many of the leading standards organizations – CDP, the CDSB (Climate Disclosure Standards Board), GRI, IIRC (International Integrated Reporting Council), and SASB – announced they will be working in the coming years toward a ‘shared vision’ for more harmonized reporting across each one's respective standards (which, as mentioned, already resulted in the integration of SASB and IIRC).

As of early 2022, the European Union (EU) has yet formalized its new Corporate Sustainability Reporting Directive (CSRD) requirements. However, we expect these to go into effect by the end of 2022. You can read the current drafts and documentation around the new EU sustainability reporting standards here.

Sustainability Reporting Data Collection and Governance

Sustainability reporting doesn’t exist in a vacuum within your organization. Quite the opposite in fact: it's incredibly broad and holistic in scope, with considerations for nearly every department and area of your company's strategy and operations.

When implementing sustainability and ESG programs, it's important to make sure sustainability leadership has strong executive support and buy-in. Moreover, in addition to a dedicated, internal sustainability team, many organizations set up one or more ESG committees. These committees can be constructive at the executive or board-level to ensure support and resources for strategic sustainability issues, targets, initiatives, announcements, and performance metrics.

We also recommend a management or department-level sustainability or ESG committee to serve as the conduit between the sustainability team and internal departments who sponsor, support, and share data around specific environmental initiatives. This might include HR for climate-related employee engagement programs, CSR for specific non-profit or community partnerships, or Product, Operations, and/or Facilities for environmental footprint-related information and accounting.

Many ESG and sustainability reporting frameworks provide ways to bridge these gaps between areas like environmental sustainability and other departments like financial accounting, risk management, and compliance, but it's important to go beyond that. Educate employees and teams, create employee engagement opportunities tied to your ESG and sustainability initiatives, and make sustainability part of your organization's culture to truly put it at the center of your brand, strategy, and purpose.

Since many sustainability teams run fairly lean, organizations often need external capacity help from consultants and technology partners. As you embark (or continue) along your sustainability reporting journey, it can be helpful to ask questions like:

- What resources do you have to dedicate to sustainability program and project implementation?

- What resources do you have to dedicate to sustainability and environmental data collection, management, and reporting?

- Do you have enough reporting team capacity during peak reporting season?

- What are the cases and opportunities to bring in outside help to make this process more efficient, transparent, and effective?

For example, Brightest's unified sustainability reporting software provides tools for target-setting and tracking, project execution and evaluation, data collection and surveying, carbon accounting, and sustainability report generation all in one system, sort of like a "Turbotax for ESG." Our tools and strategic support help organizations get report-ready faster, do more with less, and keep everything sustainability-related in one central, secure place.

Need an audit-ready system for sustainability reporting?

Brightest helps hundreds of companies measure Scope 1, 2, and 3 emissions and report climate performance

An ESG sustainability reporting scorecard example from TD Bank. Source: TD Bank

How to Create a Sustainability Report

Sustainability reporting typically follows annual cycles that closely align to a company’s fiscal year-end and financial reporting cycle. For example, it’s common for a company whose fiscal year ends December 31st to start its Sustainability and ESG reporting work in November or December with the goal of completing and issuing the report in the spring of the following year, around IRS and financial reporting timelines.

From a content perspective, how you organize and present your report is up to you, but it's likely helpful to include sections that provide:

- An executive summary with highlights

- A description of your sustainability process, methodology, and any frameworks used for guidance

- Your sustainability targets, KPIs, and performance

- An ESG ratings and performance summary for investors (particularly if you are a publicly traded company)

- An overview summary of your financial performance and economic development value created

- An explanation of your company's mission and top sustainability and materiality themes

- A detailed, data-driven description of your sustainability performance across each materiality theme

- A carbon accounting and environmental footprint overview, with supporting data

- Any highlights, awards, press, or other relevant ESG-related third party recognition

- Your ESG, environmental, and climate risk management approach, highlighting key risks and opportunities for your business

Stick to your materiality pillars and focus on what matters. It's better to do a few big, material, and impactful things well then spread yourself thin or report on lots of little incremental changes. When preparing your sustainability report, it's also helpful to consider several important questions:

- Who is the stakeholder audience of your disclosures? What stakeholder groups should be informed of your sustainability work?

- What do you want your audience(s) to understand about your sustainability efforts and performance? Again, what's most material?

- Should your report be structured around one or more ESG or sustainability standards? If so, which one(s)?

- What are your data management and governance processes for collecting sustainability data? Where does it live in your organization today? How are you accessing it? Make sure to map out all your data sources.

- Who is reviewing and approving the data going into your report? What is your review process to receive sign-off from corporate communications, finance, legal, compliance and other relevant internal departments? How will you track all that?

- Do we need external, third-party assurance of our report? Who will conduct the assurance review?

- What creative resources do you need (design, data visualization, editing, etc.)?

- Which corporate communication channels will be used for the release? Are there any dedicated website, press, social media, and/or internal communication campaigns to share the results?

- What are the relevant risks and regulatory considerations around your reporting disclosure?

- Where will your report methodology, inputs, and underlying data be archived?

- How do we improve and make better progress toward our targets next year?

Once you've answered and planned those questions, gather your data, review and verify it, create your sustainability report, then complete your internal stakeholder review and signoff process. Make sure to also work closely with Corporate Communications to craft your release plan and messaging.

Remember, different groups will be interested in different aspects of your sustainability efforts. For example, investors likely have different criteria and areas of interest compared to your employees. It’s critical to identify and understand these different interests to tailor your communication strategies to share relevant information and results for each group.

Whatever you decide, don't put out a sustainability report full of greenwashing.

Your Next Steps With Sustainability Repoerting

ESG and sustainability are both strategic considerations for companies and executive teams. This makes sustainability measurement and reporting an important communications cycle for modern organizations, particularly publicly-listed companies, ones operating in specific regulatory regions, or ones who need to meet specific supplier compliance obligations. While sustainability reporting exellence can be complex and does require internal capacity, resources, and investment, it also adds a meaningful boost to your firm's brand, reputation, employee morale and retention, and risk management efforts.

Increasingly, sustainability disclosure can even preserve — or open up new — customer relationships and de-risk revenue.